April 30th, 2018

It appears that the recent period of low volatility and steady gains has ended. Investor psychology quickly shifted from highly optimistic to highly anxious. Worries about international trade, South Korea, and rising interest rates are outweighing expectations of strong earnings. Over the last few weeks, the market seems to have found some support, but day-to-day volatility is much higher than last year.

Globally, most markets are relatively flat year-to-date. International markets are doing a bit better than the U.S. as dollar weakness is supporting the values of foreign companies. Fixed income securities are lagging stocks with the aggregate bond market down about 1.5% for the year.

The main narrative for stocks remains unchanged. First quarter earnings were strong, and the consensus forecasts for ’18 and ’19 are moving higher. With 60% of the S&P 500 companies reporting so far, earnings are up 28%. By some measures the current quarter is shaping up to be one of the best in history for earnings growth. This provides very strong support for the low end of the S&P 500 trading range – 2550-2600. Until there is more confidence in the duration of the economic cycle investors will be reluctant to push the valuation multiple higher, which makes 2750-2800 on the S&P a ceiling for now.

Barden Capital portfolios that hold individual stocks and bonds are beating their benchmarks so far this year. During the first quarter, our stock portfolios were up about 2.25% while our global benchmark was down 1.15%. The fixed income portfolio was up 2.8% while the aggregate bond market benchmark declined 1.45% for the quarter.

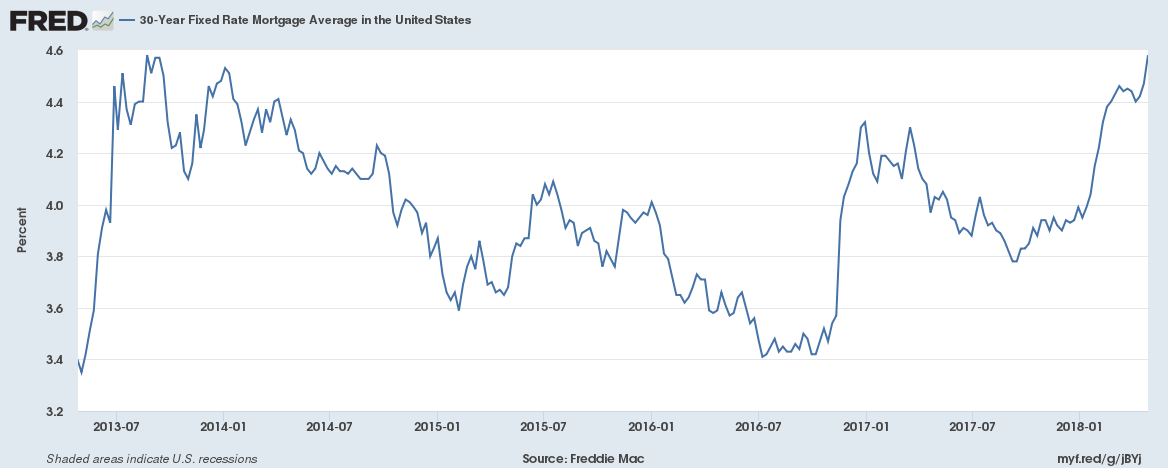

Our fixed income portfolios are succeeding despite gradually rising interest rates. We don’t own any long-term Treasury bonds. Long-term treasuries are more vulnerable to rising rates. Most of our fixed income portfolios have at least 20% invested in interest-only mortgage backed securities. The unique attribute of this asset class is that when mortgage rates increase, the value of these positions also increases.

Interest only mortgages appreciate when interest rates increase because homeowners are less likely to refinance their mortgages. When we buy interest only securities, we are buying the rights to the future interest payments. If interest rates increase, the number of homeowners that refinance decreases.

Foreclosure, refinancing, and relocation are the major reasons homeowners pay off mortgages early. A strong economy increases employment, which reduces foreclosures. A strong economy also causes higher interest rates, which decreases the propensity for homeowners to refinance their mortgages. This results in a decrease in the rate of prepayments. As the rate of prepayments decrease, the present value of the future interest payments increases, which causes the value of the position to increase.

These securities are working exactly as intended. If interest rates continue to rise, then the projected value of the interest only mortgages will continue to increase. They act as a hedge against gradually rising interest rates. I’m very pleased that we could bring this strategic allocation to our individual accounts as these securities are typically reserved for large institutional investors.

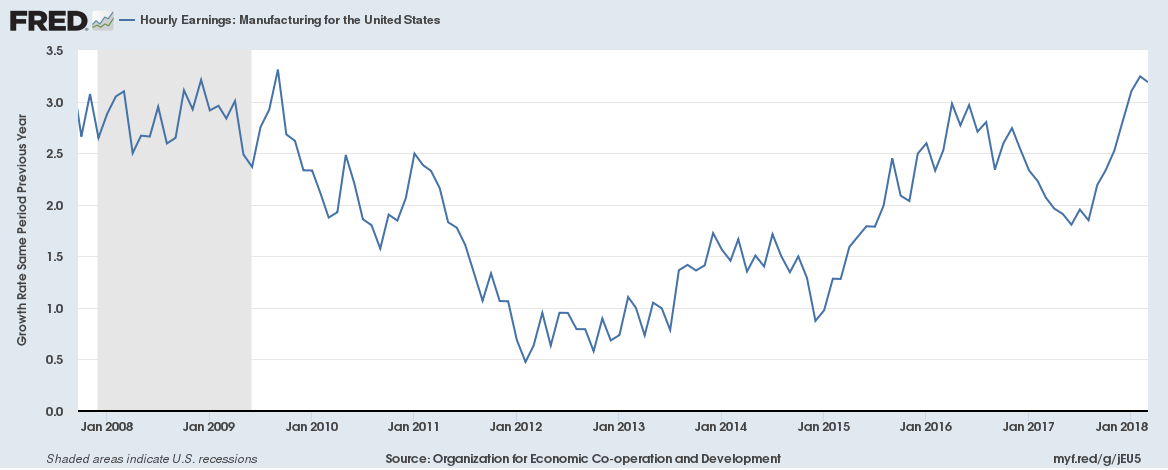

We have probably seen the lows for interest rates. Interest rates move in the direction of inflation. Inflation becomes more of an issue as the economic expansion matures. We are somewhere in the later innings of one of the second-longest economic expansions in U.S. history. As expansions progress, resources become scarcer. Wages go up as employers compete for labor. Employment inflation tends to drive the level of interest rates. With unemployment at ten-year lows, wages are likely to rise. During the first quarter of this year, wages rose the fastest since 2008.

Wage inflation accounts for about 70% of overall inflation. Economists credit automation and globalization with suppressing wage growth over the past thirty years. We may be on the verge of testing the theory that inflation is less of a risk today than in the ‘70s and ‘80s.

Besides interest-only mortgages, stocks are one of the most effective hedges against rising inflation. Corporations are a prime beneficiary of inflation. Price increases flow straight to the bottom-line. A decent economy creates an environment that allows earnings to grow.

Not all stocks benefit equally from inflation. Slow growth, high dividend paying stocks have a lot of similarities to bonds. As interest rates rise with inflation, bonds provide stiff competition to high dividend yield stocks. As is the case this year, high dividend paying stocks in industries like utilities, telecommunications, and defensive consumer stocks tend to lag the rest of the market when inflation increases. Your stock portfolio has been under-weight these defensive, dividend-oriented sectors for a few years based on the assumption that interest rates would increase.

We are concentrating your portfolios in undervalued companies that produce strong cash flow. The goal is to create a defensive buffer that should stabilize the portfolio during periods of market volatility. The portfolio reflects our belief that the current period of economic growth may still have a couple of years left, but that we are certainly closer to the end of the cycle than the beginning. When the economic backdrop changes, the strategies that we employ to maximize your portfolio’s return will also change.

I’m still hopeful that the S&P will reach 3,000 this year, which would give us an additional 13% return between now and the end of the year. It’s not unusual for the market to tread water for a bit after a period of strong gains like we’ve seen over the past eighteen months. Assuming we avoid a recession, the market should break out to the upside of the current trading range.

Eric Barden, CFA