February 5th, 2018

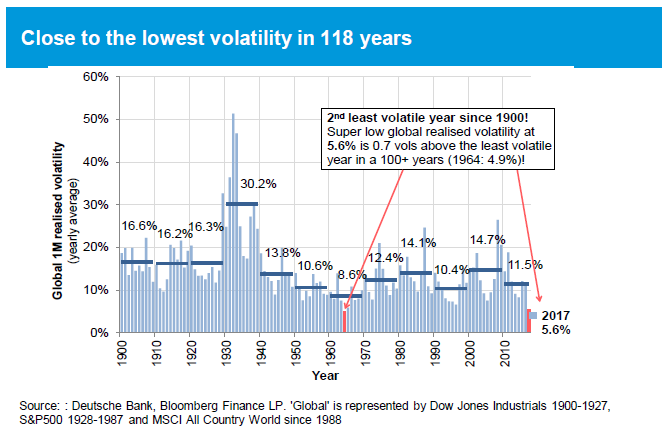

This is not normal. It’s not that returns are excessively positive. A 20% return year is not unusual. What is unique is the consistency of this advance. The average peak-to-trough decline for stocks within a calendar year is about 14%. In 2017, at no point did the S&P 500 fall more than 3% from an all-time high. Market volatility is inevitable and a normal component of investing in the stock market. It now appears that we are getting the first real market shakeout since 2016. This isn’t too surprising given how positive investors had become. The real tell will be how quickly investor psychology turns. My guess is that we are more than half-way through the turbulence.

The latest shake-out is more about investor psychology than economic fundamentals

“Globally synchronized economic recovery”

No investment strategist foresaw that the market would appreciate like it did in 2017. Twice a year, Barron’s polls the chief investment strategist at 10 of the leading Wall Street firms. The average expectation at the beginning of 2017 was that the S&P 500 would end 2017 at 2,380. They substantially underestimated actual results. The S&P 500 ended the year at 2,673, almost 300 points and 12% higher than the average forecast. Early returns in 2018 suggest that the stock market rally continues.

Current economic conditions are about as good as they get. The world’s leading economies are enjoying a rare period of synchronized economic growth. The U.S. has led the global economic recovery out of the credit crisis of 2008-9. After stumbling through the Greek currency collapse of 2012, Europe’s economy has slowly regained forward momentum. Japan is in the middle of its longest streak of positive quarterly growth in over two decades. China seems to be driving the recent rally in stocks. After crashing 45% in 2015, Chinese stocks were up more than 50% in 2017. Since the Chinese stock market hit bottom, the S&P 500 total return has been positive 21 of the last 22 months.

Higher stock prices mostly result from higher corporate earnings

2018 is probably not going to see the end of this bull market. Leading economic indicators suggest that the economy continues to slowly accelerate. This slow but steady pace of growth combined with stable low inflation is why economists refer to the current economy as “Goldilocks”—not too hot, not too cold.

The factors that would suggest a recession is imminent are not present today. So, if we assume that the economy continues to grow at a rate of between 2% and 3%, high inflation is unlikely. This means that the Federal Reserve will persist on their course of slowly raising short-term interest rates. If the Federal Reserve raises rates at a pace that the market anticipates, interest rates are not going to be the dominant factor in market performance.

As the economy grows, investor psychology improves. Higher confidence in the economic outlook increases the valuation that investors are willing to pay for a stream of growing earnings. At the beginning of this year, analysts forecast earnings growth of about 8%. The combination of earnings growth and higher valuations suggests that the market should achieve better than average returns in 2018. We are already up more than 7% through January.

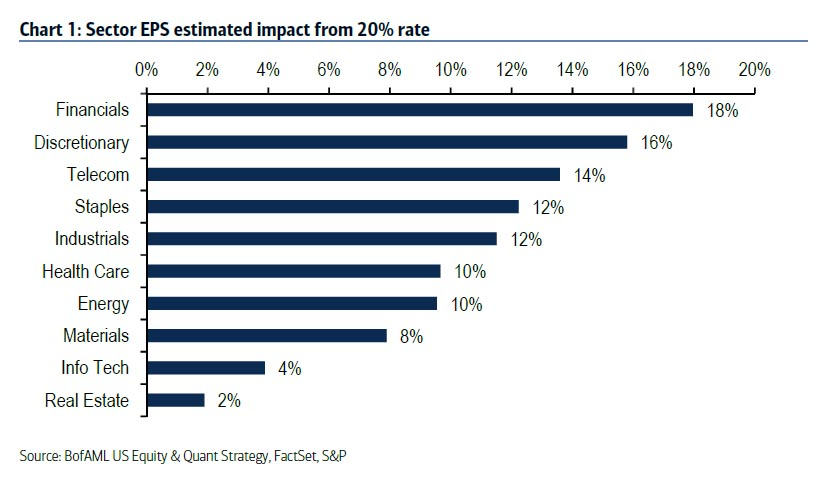

The tax cut that will go into effect this year will substantially reduce the tax rate for U.S. based corporations. Cutting the corporate tax rate from 35% to 21% will immediately increase corporate earnings. This increase in earnings is not fully reflected in analyst estimates, but early indications are that the S&P 500 should achieve earnings of at least $160 per share.

The corporate tax cut increases corporate earnings

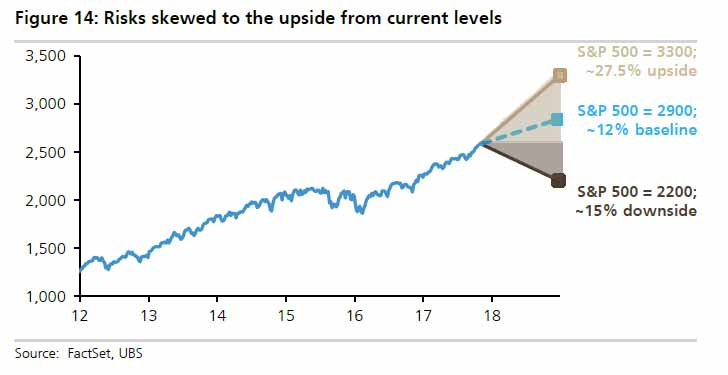

Stocks could increase 20% this year

If stocks trade at a modestly higher than average multiple of twenty times forward earnings, the S&P 500 could be worth more than 3,200 later this year. Despite the strong year in 2017, my best guess is that the S&P 500 will return more than 15% in 2018.

Interest rates are increasing moderately

The outlook for interest rates is less appealing. A Goldilocks economy combines positive economic growth with low inflation. If anything is going to change, it’s likely that inflation will accelerate. As inflation increases, the Federal Reserve will continue to raise short-term interest rates. Right now, the market expects the Fed to increase interest rates 0.75% in 2018. The largest segment of the bond market, U.S. Treasuries, are the most vulnerable to rising interest rates. Fortunately, we have structured our individual bond portfolios in such a way that they are insulated from higher interest rates. Despite higher interest rates in 2017, our bond portfolios substantially beat the bond benchmark.

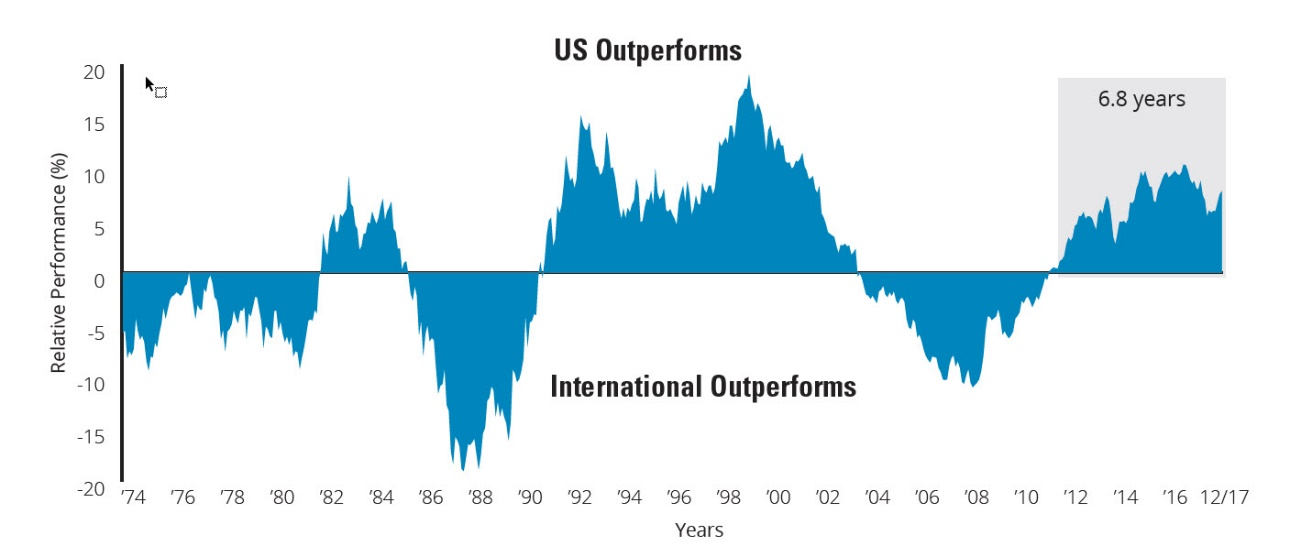

International stocks are poised to take over leadership from the U.S.

Although the market should continue higher in 2018, there could be a major change in leadership. For the last ten years, U.S. stocks have outperformed the rest of the world’s markets from a U.S. investor’s perspective. The dollar has also enjoyed an uninterrupted period of appreciation against the rest of the world’s currencies. I don’t want to oversimplify, but if the dollar begins a multi-year period of weakness against global currencies, it is very likely that our international stocks will beat our U.S. based companies. These cycles are hard to predict so it’s most efficient to maintain a constant allocation to companies outside of the U.S.

If your asset allocation correctly reflects your time horizon, short-term performance does not matter!

History demonstrates that markets will experience a wide range of returns year to year. The most important factor to your success as an investor is how well your portfolio’s asset allocation reflects your long-term objectives. It’s tempting to increase our allocation towards whatever asset class is performing the best, but chasing past performance is rarely successful.

The best investors use capital markets as a tool to serve their highly defined objectives. They do not deviate from their purpose. If you have any question as to whether your current portfolio aligns with your investment objectives, please don’t hesitate to call me to discuss. Our primary mission as investment advisers is to translate your objectives into an investment portfolio that will most efficiently serve your purpose.

Eric Barden, CFA