October 24th, 2018

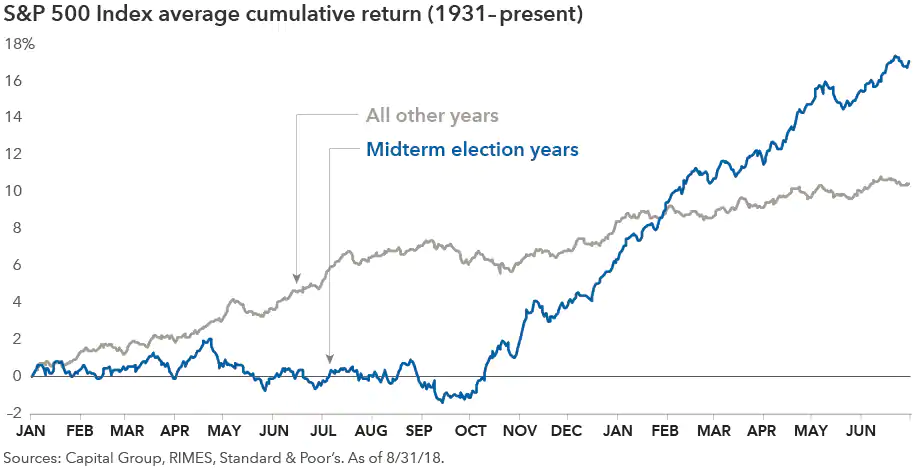

Generally, the market sells off in the months leading up to the election. This is a statistic that is hard to explain, but that we shouldn’t ignore.

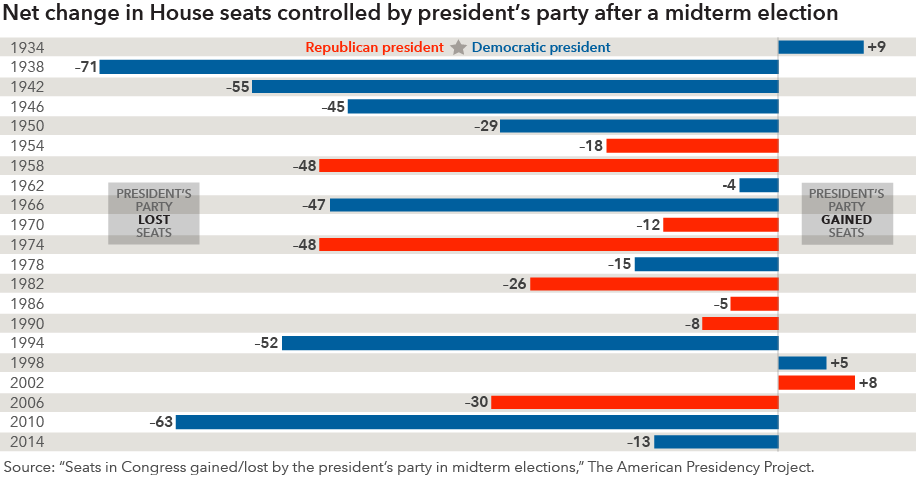

It doesn’t seem to matter which party is up or down after the midterms, or even if there is a change in control in congress. Historically, the President’s party loses seats in the midterm. This is one of the most predictable cycles in politics.

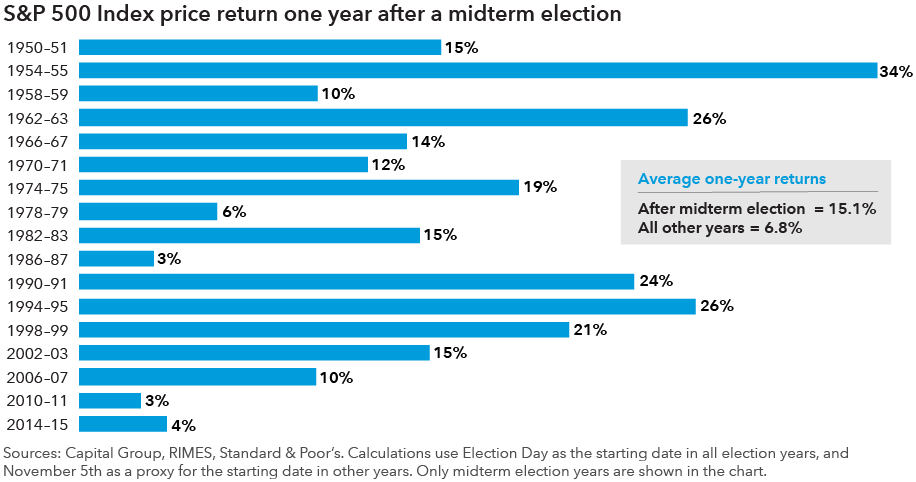

The voting public tends to moderate the results of the previous election. Moderation reduces the range of possible economic policy. This reduces the level of uncertainty which means that investors are willing to pay more to bet on future growth. There have been eighteen midterm elections post World War II. The U.S. stock market has been positive the following year after every single midterm election since WW II.

Year to date, through the end of September, we are exceeding our expectations for equity returns and we are matching our expectations for fixed income.

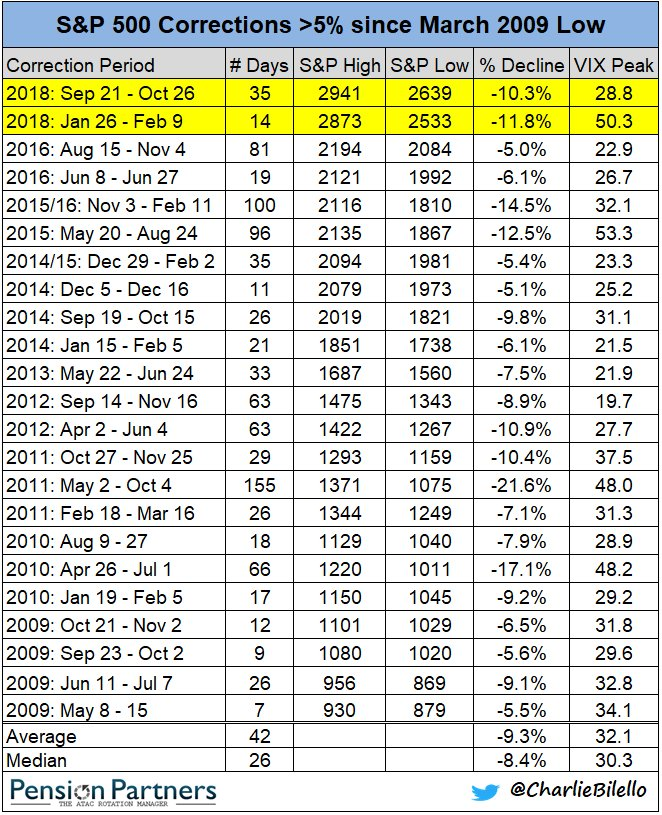

The average correction over the last ten years has been about 9%. The average time to recover to new highs has been about 45 days. Often, these downdrafts have little or no basis in economic fundamentals. These volatility storms seem to be a feature of the current market structure. This is the 25th time stock prices have dropped more than 5% since the beginning of the current bull market in the spring of 2009.

The S&P 500 was up 7% in the third quarter. This is the best performance for the S&P 500 in over five years. The recent volatility, like hurricane Michael, seemed to come out of nowhere. We just finished the rare quarter during which the S&P 500 never moved more than 1% in a day.

Many large pension funds use a fixed asset allocation to guide their investment portfolio. If a pension is 50% stocks and 50% bonds, after stocks have an outstanding quarter like we just finished, the pension fund needs to sell stocks and buy bonds solely to get its asset allocation back in line. It’s not unusual to see big reversals in the stock market after extremely strong quarters.

Other large investment funds use what’s called a “risk parity” strategy. Rather than maintain a consistent 50/50 asset allocation, this strategy aims to diversify the volatility of the portfolio. When volatility rises, the strategy reduces exposure to stocks. Once volatility subsides, the full stock allocation is reinstated.

The problem with this approach is that if the volatility profile of an asset class suddenly increases, the portfolio needs to reduce risk by selling that asset class at the worst possible time.

There are many other program or “bot” based strategies that follow short-term trends. The result is a market structure that tends to behave irrationally by making mountains out of molehills. These sellers are decreasing exposure to stocks for reasons that have nothing to do with the prospects of the underlying companies or the economy. This creates an opportunity for long-term investors who can add to their stock portfolios during times of volatility.

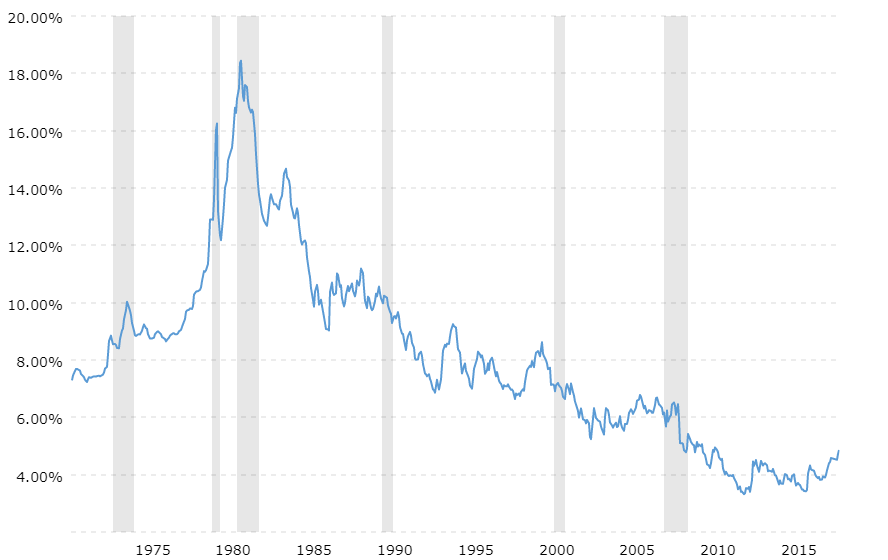

The most pressing concern about the economy is that it can’t get any better than this without triggering an increase in inflation. The Federal Reserve remains determined to move short term interest rates up into a historically normal range. The best guess is that they will increase interest rates by one-percent between now and the end of next year. This suggests that thirty-year fixed mortgages could reach as high as six percent. This isn’t high by historical standards, though it would be the highest rate since before to the credit crisis.

30 Year Fixed Mortgage Rates

The economy is always changing, so it is difficult to model the economic impact of rising interest rates. Certainly, higher rates will dampen economic activity, but the question is how much, and how much of a slowdown is already embedded in market expectations. The Federal Reserve projects a long-term U.S. growth rate of 1.8%. For 2019, the Fed expects 2.5% growth and 2.0% growth for 2020. Independent analysts like Deloitte and Touche forecast a 75% chance of continued growth through 2020. This is in stark contrast to the beliefs of 75% of the world’s ultra-high net worth investors who think we will experience a recession before the end of 2020.

The bears argue that earnings may not increase in 2020, and 2019 will be the peak for earnings. My view is that 2019 will be the peak in the rate of earnings growth, but not the peak in earnings. Earnings should grow through 2020 but at a slower rate. If the economists are correct and we are not on the verge of an unforeseen recession, stock prices should recover to make new all-time highs within the next six months.

Higher tariffs won’t be enough to cause a recession, but they will impact growth which makes the overall economy more vulnerable to unforeseen shocks. Growth will slow over the next year, but if economic growth remains positive, earnings will also continue to grow. Eventually, stock prices follow the path of earnings growth, but prices and fundamentals can diverge for extended periods.

Through the end of September, our stock portfolios were up about 30% since the beginning of 2017. Today, despite the recent sell-off, the primary bull market in stocks is still intact. Over the next couple of weeks, we will get through the turbulence of earnings season and of the mid-term elections.

Major market moves occur when reality plays out differently than what the consensus expects. It seems that the consensus is pessimistic about the economic outlook over the next couple of years. If the Federal Reserve is correct, and the economy continues to grow for longer than what the consensus anticipates, stock prices should grind higher along with earnings growth, while fixed income will likely continue to produce stable, but meager returns.

Eric Barden, CFA