Slow and steady is the best way to describe market conditions for the first part of 2015. Year-to-date, most stock allocations are up about 3-4%. Over the last three years, stock allocations are growing at almost twelve percent annually.

The Quest for Low Risk Returns

The most pressing challenge for investors is what to do with the assets that they want to use within the next two years. Historically, savers could buy a CD or government bond and comfortably earn interest in excess of the rate of inflation. This allowed savers to invest a portion of their portfolio in extremely safe, low-risk investments.

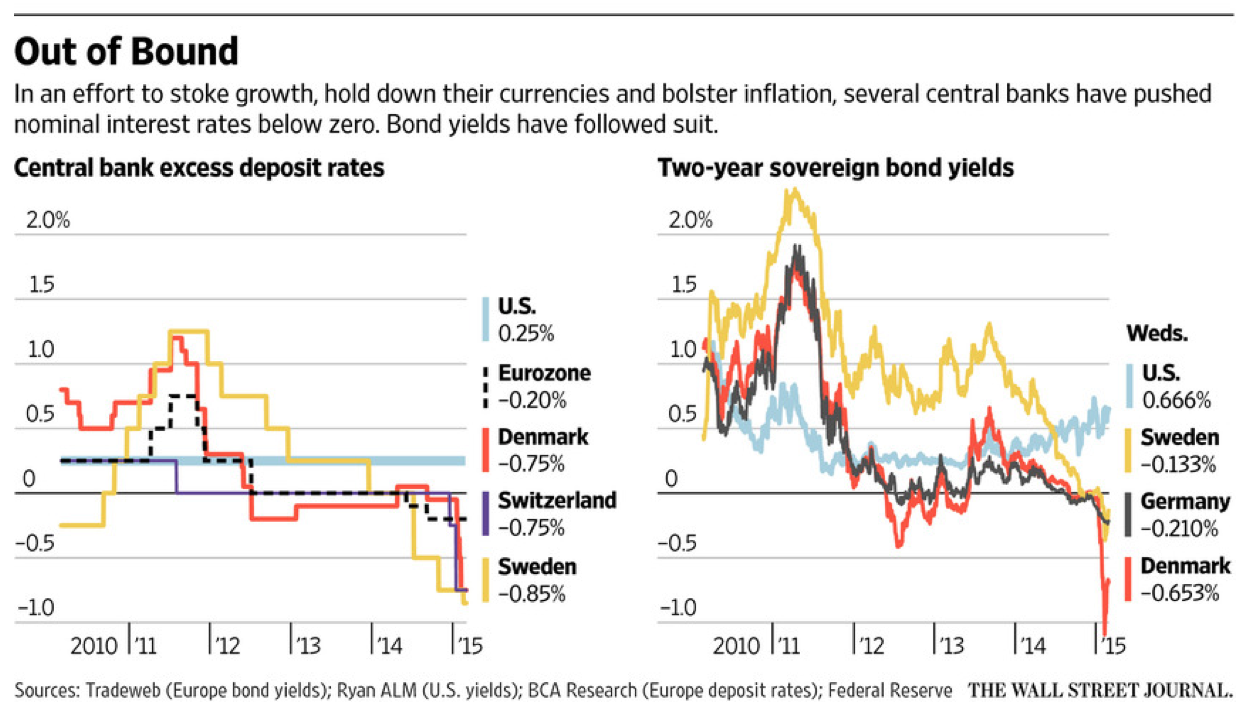

Today, the governments of Sweden, Switzerland and Denmark have set official interest rates below zero. U.S. Short term interest rates of one-half percent are well below the current two percent rate of inflation. A negative real savings rate for conservative investors and savers means that in real terms, savers are paying low-risk short-term borrowers when they lend their savings. Over time, this forces a declining standard of living for savers who are living on a fixed income.

All around the world, governments are taking action to force interest rates lower. While this is a huge windfall for borrowers, it creates a challenge for savers. Commonly referred to as quantitative easing, the goal is to force investors to take more risk. Savers and retirees who planned to roll over CDs or earn a modest interest rate on their savings are collateral damage of the governments’ attempts to revive their economies.

Extraordinary Policy Inflicts Pain on Low Risk Savers

The Federal Reserve is currently holding interest rates about one and a half percent below inflation. Estimates are that savers are losing about $480 Billion a year relative to where interest rates have traditionally been. The Federal Reserve will likely raise interest rates by only one-quarter of a percent later this year, but no one has any idea how quickly the next rate hike will occur. All indications are that they will normalize interest rates very slowly. The best guess is that it will be two or three more years before short-term interest rates exceed the rate of inflation.

The Dilemma: Increase Risk or Reduce Long-Term Income Projections

Savers have to figure out how to make up the loss in income from their savings. They only have two options. First, they can reduce their spending. Reducing the rate at which you draw down a portfolio extends the life expectancy of the portfolio. If the objective is to maintain the level of income that the portfolio can support, investors need to increase the amount of credit risk in the portfolio. This means moving away from CDs and savings towards mortgage and high yield bonds. The eternal tradeoff in finance is risk and reward. The greater the risk in the portfolio, the greater risk that our return assumptions are overly optimistic.

Portfolio safety is a luxury that very few can afford these days. The primary objective is to at least exceed inflation. To get an interest rate in excess of inflation, we can lend to the highest quality borrowers for at least ten years. Over ten years you can be confident that you will earn 2% a year and that your borrower will pay you back ten years later.

If interest rates increase during that ten year holding period, the market value of your bond will decline. Eventually, you will be paid back in full, but if you need to sell the bond prior to maturity, you may get paid less than 100% of what you lent. Patient investors who seek a highly predictable long-term outcome, and who don’t require a great deal of growth to support their long-term lifestyle are perfectly suited for this conservative portfolio.

For the other 99% of the population, we have to figure out a way to manage our risks in light of our personal preferences. If we prefer to minimize the volatility of our portfolio we assume the risk that we will have to get by on less. If we want to protect our standard of living, we have to assume more risk in our portfolio.

The Economic Recovery Continues

The good news is that the recovery continues to progress. Low interest rates support increased investment around the world. The cost of borrowing for households has rarely been lower. The low cost of borrowing gives households and corporations the opportunity to reduce the amount of debt they owe. Now that the decline in unemployment is more apparent, low and middle income households have the confidence to move out of the apartment and buy a house.

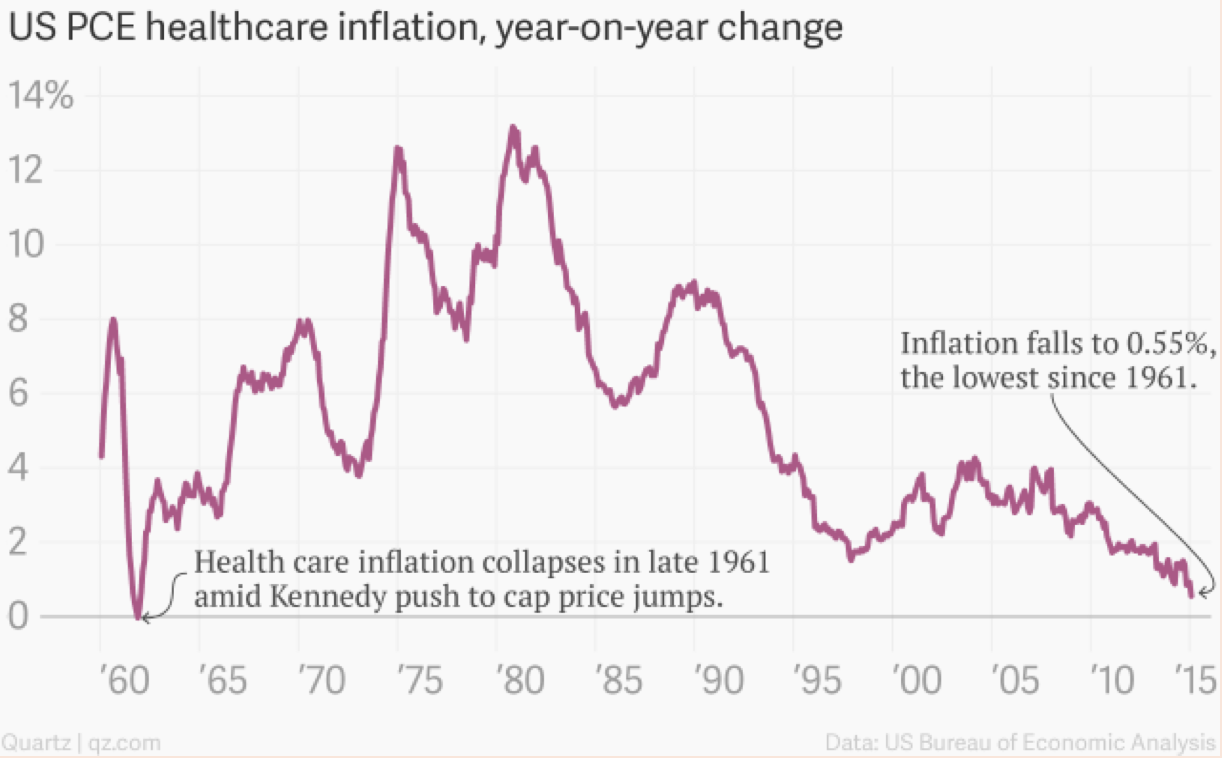

Household confidence received a boost from the surprising drop in energy prices. This further allows them to either pay off debt, or increase the standard of living. Recently, health care inflation has been a substantial component of overall inflation. Now, even health care costs are stabilizing. Health care inflation is at its lowest level since 1961.

It’s been almost five weeks since the market made a new all time high. That’s the longest stretch without a new high in about two years. In spite of a disappointing first quarter in terms of economic growth and earnings growth, all indications are that the slowdown in growth was a weather related pause. The economy will likely make up for the slowdown by exceeding expectations for the rest of the year. The re-acceleration of economic growth should propel the stock market to new all time highs by the end of the year. Once the dollar finds a stable level against international currencies, the stocks of our foreign holdings should better reflect the strong performance of international markets.

We’ve moved past the primary snapback recovery from the credit crisis of 2008-9. Now, we are starting to get a sense of what the new normal will look like. The primary challenge of the next era will be the much more stingy return for low risk assets. This forces us to successfully balance the risks of market volatility with the risk of a diminished return on our savings.

Concentrating our stock portfolio in high quality, undervalued stocks with robust earnings growth helps ensure that our portfolio will recover even after the inevitable periods of economic and stock market weakness. Historically, the value of stocks drops 20% about once every nine years. I don’t expect we’ll see a bear market in the next couple of years, but they are an inevitable reality of long-term investment in the stock market. The eternal dilemma is that the most reliable means of building long-term wealth is the most volatile in the short-term. How we reconcile that short-term volatility with our long-term investment objectives is the core challenge of asset management.