Several of our clients have been with us for almost twenty years, and we are grateful that they share our focus on long-term performance. They have experienced prior periods when our investment approach has been out of step with the market. Of course, our job is easiest when we’re outperforming on a long and short-term basis, but there are some periods when keeping up with the market in the short-term risks long-term performance. This appears to be one of those times.

Reminder That the Stock Market Isn’t Always Slow and Steady

The kind of decline we’re seeing this year is very typical, if not fairly mild. Going back to 1980, the average intra-year peak to trough decline for stocks is 14%. Only 8 out of those 34 years ended down for the year. The S&P 500 averages about three declines of 5% each year. In spite of this turbulence, in 1980 the S&P was around 100 and today it is around 2000.

The average investor does not have the ability to appraise businesses. The average investor tends to react based on their short-term perception of reality. The average investor does worse in stocks than they would do in money markets. Perception of reality is far more volatile than the underlying reality; in fact it tends to be pretty manic. As a result, the market has a temperament similar to a 4 year old (down 200 two days ago, up 200 yesterday, down 200 today).

Volatility is not fun and can be very stressful, but changing your long-term portfolio objectives in reaction to short-term market volatility would be like jumping out of a plane in response to turbulence. You’ll solve the turbulence problem, but you won’t get to your desired destination. The best advice for dealing with the turbulence is to put on some headphones and try to relax. You don’t know how long it will last, but except in very, very rare circumstances the plane isn’t going to crash. Except for shorter distances, flying still beats driving (bonds) or walking (cash).

Seeing Past the Uncertainty

We invest based on fundamental reality. We own attractively priced, high quality companies that are growing earnings in a robust way. Generally, when our stocks go down, the expected return goes up. If we get our business appraisal right, eventually perception will catch up with reality, regardless of how volatile the market is in the meantime. We can’t go wrong if we’re able to buy at 60 cents on the dollar and sell for a dollar.

We lagged in 1999 when everyone dove into dot-com stocks. We lagged in 2012 when everyone was sure that the Euro would break up. In both of these instances, we made up the underperformance and then some in subsequent years. Today feels like a replay of 2012. Investors are worried that the 30% rise in 2013 was too much too fast. Year-to-date, Europe is down 11%, small caps are down 7%, and the Vanguard Total World Market is down 1.2%. On average, NASDAQ stocks are down 20% from their 2014 high.

We have no ability to predict when the rest of the public will recognize what is fairly obvious. As for the timing of a turnaround, it could happen at literally any moment. Very often, the market is weak going into mid-term elections, but going back to the 1920s, the market rallies about 15% after the election through the end of April.

Near-Term Strategy

Europe: Reduce exposure to companies that are sensitive to the European economy. Europe led the developed markets over the last two years, but it has not yet adopted an adequately aggressive monetary or fiscal policy. Its economies will likely lag until a consensus for action emerges.

U.S: Maintain overall allocation. Shift more of the allocation to economically sensitive stocks which are currently underperforming (may lead to near term underperformance if low volatility stocks continue to lead).

Small Cap: These companies are fairly expensive relative to large and growth companies.

Asia and Japan: Looking for specific stock opportunities. Overall economic environment is sketchy.

Emerging Markets: Valuations are very appealing, but the situation in many markets like Russia and Brazil seems to be deteriorating.

Bonds: U.S. government bonds seem overvalued. We’ve increased our allocation to mortgage backed securities which are less vulnerable to rising interest rates. Default rates are low, so corporate bonds should continue to be productive. We’re finding yield in unconventional places like cell phone towers and reits.

Return Outlook: A long term return of 8-9% allows you to double the size of your portfolio every 8-9 years. That’s a target rate of return that allows for fundamentally supported appreciation. If our investments achieve this your stock portfolio will be five times its present size in twenty years. The long-term return is much more our focus than the tracking error relative to the S&P 500.

Investors Are Crowding into Sectors They Perceive as Safest

We’ve gone through every holding in our portfolio as well as every stock in the large cap S&P 100 index to try and get a sense of what is driving performance over the last six months or so. The companies that have performed the best this year are highly overvalued relative to their growth prospects. These companies have very predictable, but lower growth prospects than most companies.

Clorox, the laundry detergent company, is trading at a price that implies a long-term growth rate of 10.3%, even though typically optimistic analysts project growth of less than 9%. For Clorox to be correctly priced it needs to drop about 15%. The price of American Waterworks, a water utility that we own, implies 11.7% growth while analysts forecast 7.6%. If the analysts are right, AWK is about 35% overvalued! Our most fully valued companies, American Waterworks, Berkshire Hathaway, and Roche are like Clorox, considered to be defensive stocks. We haven’t sold them yet as they continue to outperform due to investors’ current passion for boring, low-risk stocks.

Current Anxiety Has a Lot of Sources

No one knows precisely what is driving the latest outbreak of pessimism. Most likely, concerns about policy paralysis in Europe, combined with worries about the end of Quantitative Easing, explain most of the anxiety. We’re also grappling with the midterm elections, Ukraine, Ebola and ISIS. As a result, the market is not valuing growth stocks like it usually does or like it did last year. Companies that are growing faster are generally more highly valued (for obvious reasons).

Investors are running for cover every time they hear thunder in the distance. Think of these defensive companies as umbrellas–as long as there is a chance of rain, people are paying twice as much as they usually would for an umbrella. According to USA today, 79% of the public believes the recession is still ongoing in spite of a huge job recovery. We’ve had five and a half years of economic growth. New jobless claims are at a fourteen year low.

The fundamental reality is that the weather is actually pretty good. In terms of corporate earnings, the weather is sunny and 75 degrees, so we don’t own many umbrellas. The few we do own, we’re tempted to sell so that we can buy more sunglasses at half price.

We don’t see any indication that our companies are going to produce disappointing growth, but the market today doesn’t care. When investors get nervous the only thing the market rewards is defense. Fortunately, these periods are the exception rather than the rule. The market has almost tripled over the last five and a half years.

So the question is what to do about the volatility. Investors can dump undervalued growth stocks in order to chase over-valued defensive stocks. This could mitigate volatility and perhaps even outperform the market for a bit. But, the defensive stocks are so overvalued relative to everything else that they will very likely lag the rest of the market over the next three to five years. As confidence recovers, these companies will lag.

Key to Long-Term investment Success

The way to outperform the market over time is to seek out undervalued growth companies that will increase their value in spite of temporary economic setbacks. In order to beat the herd, you have to exploit the herd. The best opportunities for a long-term investor occur when the average investor misperceives reality (buy low, sell high). Eventually, the market will price them right, but prices can stay irrational for a frustratingly long time. Warren Buffett quotes Benjamin Graham as saying “In the short-term, the market is a voting machine. In the long-term, the market is a weighing machine.” The most productive investment processes that I know of exploit the misperceptions of the public, in order to buy high quality companies at discounted prices, so that’s what we will continue to do.

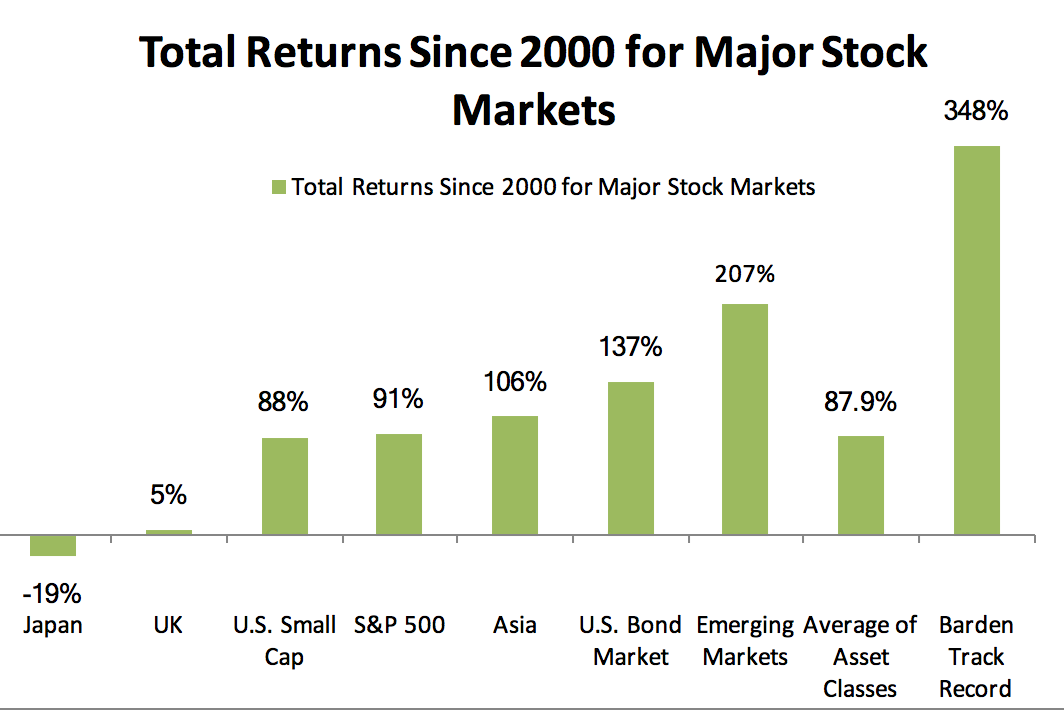

Since 2000, our stock portfolios are up 348%. The S&P 500 is up about 90% since 2000 which should help explain why I’m not a big fan of indexing. The major global stock markets experienced a wide range of returns over the last 15 years. Emerging markets achieved a total return of 200% to set the pace since the turn of the millennium.

The major markets go through long-term cycles of outperformance and underperformance. We work to find undervalued companies within each of the major global economic regions. Historically, this has led to richer returns over time, but with the strong diversification benefits of owning non-correlated asset classes. The trade-off for these long-term benefits is that at times, the S&P 500 will outperform our multi-asset class portfolio.