Investors have had a very good run in the five years since the Great Recession. The S&P 500 has nearly tripled since the market low of 2009. Interest rates for corporations are half of what they were five years ago, and bond investors have earned almost 9% a year for the last five years.

Over the last two years, our clients’ investments in stocks have grown almost 50% while the growth of the global stock market was about 45% over the same period. Our bonds are up almost 17% over the last two years while the overall bond market is only up 3.6% since mid-2012. Year to date, the market seems to be digesting some of the big gains of the last few years. Volatility is as low as it’s been over my twenty year career. The sectors of the market that lagged the most last year, utilities and energy, are playing catch up and leading the market this year. Investors also seem to be crowding into low growth, high dividend paying stocks that typically lead the market during economic recessions. I don’t suspect this will last, as the economy seems to be accelerating from last winter’s slowdown.

Fifty percent growth over two years is not normal. A large share of the gain is a onetime recovery from the depressed market of 2009. The other source of the market rally is the rapid improvement in corporate earnings. The growth in earnings appears to be sustainable for the next two or three years.

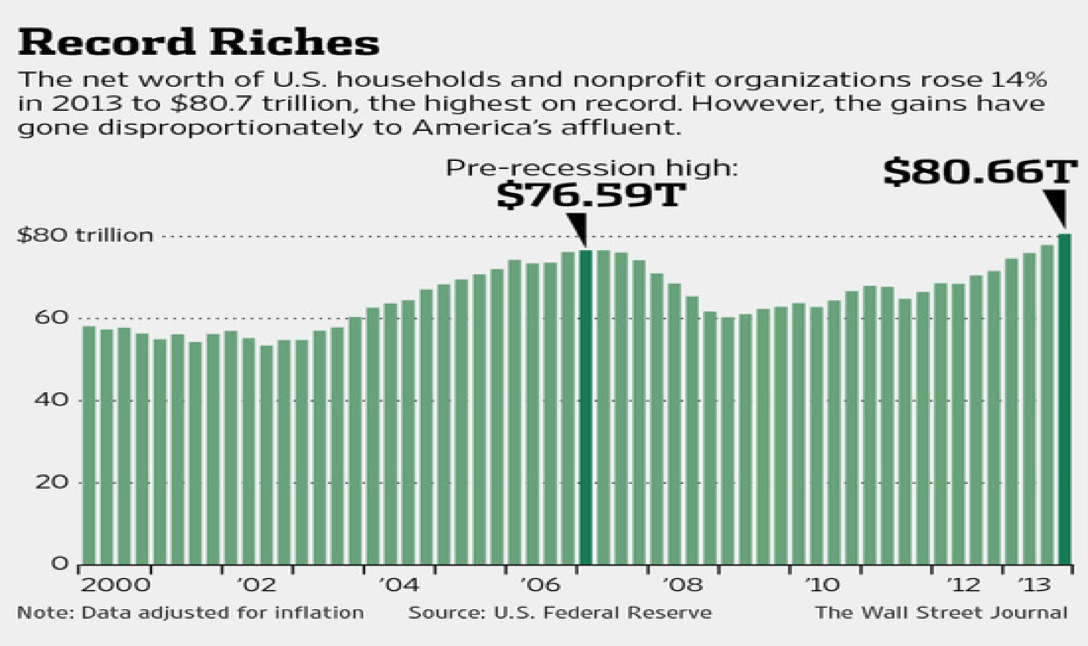

Though the economy has yet to fully recover, the recovery that we have seen so far is favoring investors much more than labor and employees. Wage growth is fairly stagnant in spite of rapidly rising earnings growth, so the biggest source of improvement in U.S. household net worth is coming from stock portfolios.

Excess returns have come at the expense of cash and savings accounts

The rate that owners receive in checking and savings accounts is tied to the Fed Funds rate, which is controlled by the Federal Reserve. The Federal Reserve tells us that it doesn’t expect to raise interest rates until 2016 at the earliest. Since December of 2008 the target range for the Fed Funds rate has been between 0 and ¼%, but inflation has stayed steady between 1.5% and 2%. Holding cash has cost investors about 2% a year in purchasing power for the last five years. Unless we want our money to pay rent to the bank or the government we need to earn at least as much as the rate of inflation.

Savings accounts are earning next to nothing, but borrowers are paying the lowest interest rates in my lifetime. Most corporations are borrowers, and they are borrowing at half the interest rate they were paying ten years ago. This expense reduction directly increases corporate profits.

The objective of the Federal Reserve’s monetary policy is to do everything possible to avoid deflation and increase inflation. Put another way, the Federal Reserve is using all of its available ammunition to increase the ability of U.S. corporations to raise prices. Higher pricing power combined with lower interest costs leads to exploding profit margins.

“Don’t fight the Fed” is one of the oldest strategies on Wall Street. Today, the objective of current monetary policy is to inflate the earnings of corporations. Corporations will use the earnings windfall to invest capital in projects that enhance their growth prospects. Higher levels of capital investment are exactly what the economy requires in order to grow at a more robust rate. As companies invest in operations and growth, they will hire more labor. The result is a virtuous cycle through which higher earnings are recycled into investment which leads to faster economic growth.

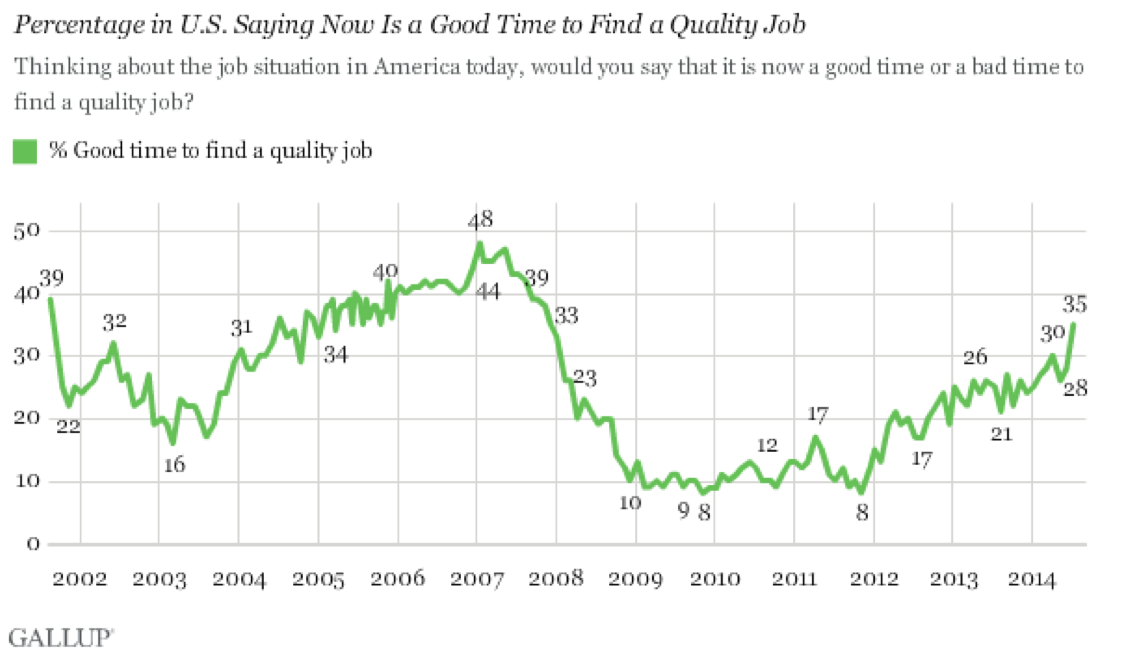

Americans are becoming slightly more confident

35% of Americans say now is a good time to find a quality job. This percentage is the highest since December 2007, the starting point of the Great Recession. In spite of widespread disapproval of Congress and the President, people are starting to feel better about their situation. There is a very real possibility that the economic expansion still has a higher gear.

If confidence continues to increase, we will see a large portion of the millennial generation move out of their parents’ basements and set up their own households. The years of establishing a household and having children are a time where we tend to spend a bit more than we earn. If these basement dwellers become heads of households with new homes and new furniture, the growth rate could get much stronger than investors currently anticipate. If this “muddle through” economy moves into a boom phase, stock market investors will pay much more than 16 times next year’s earnings. At the peak in 1999-2000, investors paid 30 times earnings, and back then you could also get 7% on a five year CD.

Based on where interest rates are today for the average corporation, the P/E ratio can probably go to twenty times earnings. Analysts project annual S&P 500 earnings of $125 twelve months from now. At 20 times earnings, the S&P 500 would be 2,500, more than 25% higher than today.

No shortage of Chicken Littles

In 2009 and 2010, many of the best and the brightest academics and investors believed that the Federal Reserve policies were misguided at best. Various groups took out full page ads in the Wall Street Journal, New York Times and Washington Post to express their concern.

These concerns along with fears about the deficit contributed to the fiscal policy gridlock in 2011, during which Congress squabbled before agreeing at the last minute to a budget that would allow the U.S. to pay interest on its government bonds. Political theatre also gave us a memorable New Year’s in 2013 when politicians struck a deal at the last minute to avoid sending the U.S. economy off of the fiscal cliff. Most recently, many pundits asserted that health care reform would cripple the economy. Regardless of the wisdom of current health care policy, the worst case scenario predictions seem unlikely to come true.

Inflation has stayed calm in a range of 1.5% to 2% over the last few years. Many of the worries that dominated the first half of the year are receding. Ukraine and Russia are simmering down. The new Chairwoman of the Federal Reserve, Janet Yellen seems to have hit her stride. There is ample evidence that the economy is re-accelerating from its winter doldrums. Job creation is very strong and consumer confidence is slowly improving. Job openings are at an eight year high. Manufacturing data and factory production are the strongest in four years.

We concentrate our stock investments into high quality growth companies that are undervalued. I don’t find the safe, but low-yielding utilities to have any long-term appeal. Our portfolios generally underperform the market during periods when investors are panicking out of growth stocks, and this time is no exception. As hedge fund managers buy into low-growth, defensive areas like utilities and high dividend paying stocks, we are staying the course with our high quality, undervalued portfolio.