Maybe Mark Twain said it best…

“No man’s life, liberty, or property are safe while the legislature is in session.”

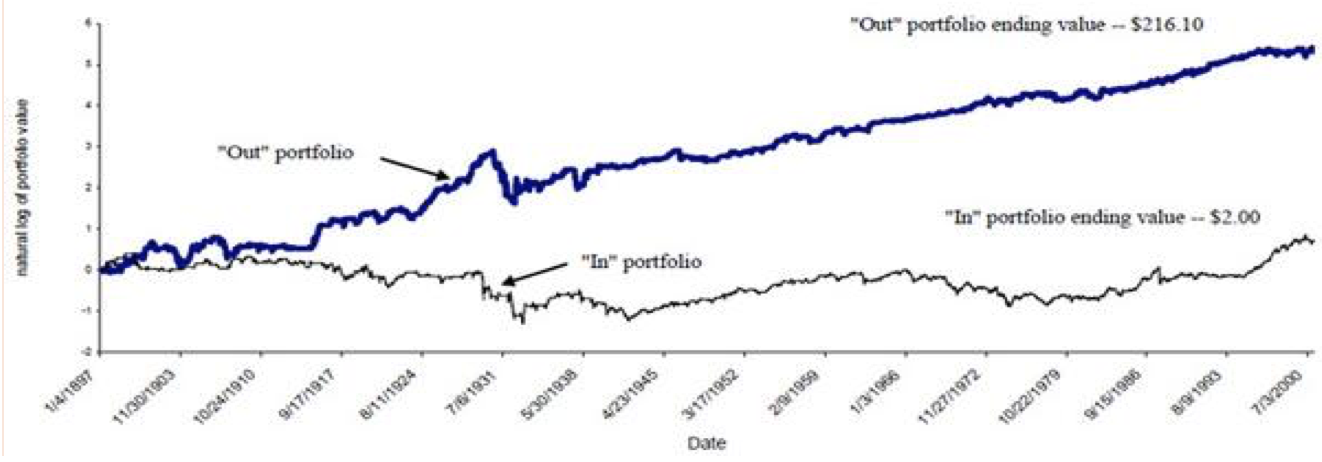

“Stock returns are lower and volatility is higher when Congress is in session. This “Congressional Effect” can be quite large—more than 90% of the capital gains over the life of the DJIA have come on days when Congress is out of session. The Effect varies systematically with the public’s opinion of Congress: returns are lower and volatility higher when a relatively unpopular Congress is active. Public opinion appears to play a fundamental role in market prices. This is consistent with a mood-based explanation that sees Congress as ‘depressing’ the average investor. (Michael F. Ferguson, Hugh Witte, March 13, 2006)

Consumer confidence dropped 12% in the last week. This is the most severe mood swing since the Lehman bankruptcy in 2008. Regardless of whether a government shutdown has any real world implications, symbolically, a shutdown is a sign of government dysfunction. The latest Gallup poll shows that politicians are now the top concern of the American public (33%). The economy/unemployment was second (31%), with concerns about the debt/deficit (12%) the third most worrying.

Stock prices dropped 4.8% between September 18th and October 9th. By October 16th, the market had rallied more than 4%. The quick rebound was the result of the House Republicans signaling that they would go along with the Senate compromise which opens the government and raises the debt ceiling until early next year. So, the bad news is that we’re going to continue to hear about the debt ceiling while Congress works to find a long-term agreement. The good news is that after a similar game of chicken over last year’s, investors had a good sense of how this will be resolved.

In the third quarter, stocks continued to perform very well. U.S. stocks were up 5%, while foreign stocks were up about 10%. Europe continues to recover from its recession, and while it’s not booming, the fact that the economies are slowly improving is enough to increase investor optimism about the eventual economic recovery in Europe.

The types of companies that are beating the market are very different from 2012. In 2012, the stable, defensive, high dividend stocks led the companies that perform best during a period of robust economic growth. This year, international companies, and companies that are most leveraged to the economy are carrying the market higher. At first, this seems surprising given the worries about the slow economy. But, when we look more closely at the economic data, it’s clear that the private and corporate sectors of the economy are doing very well.

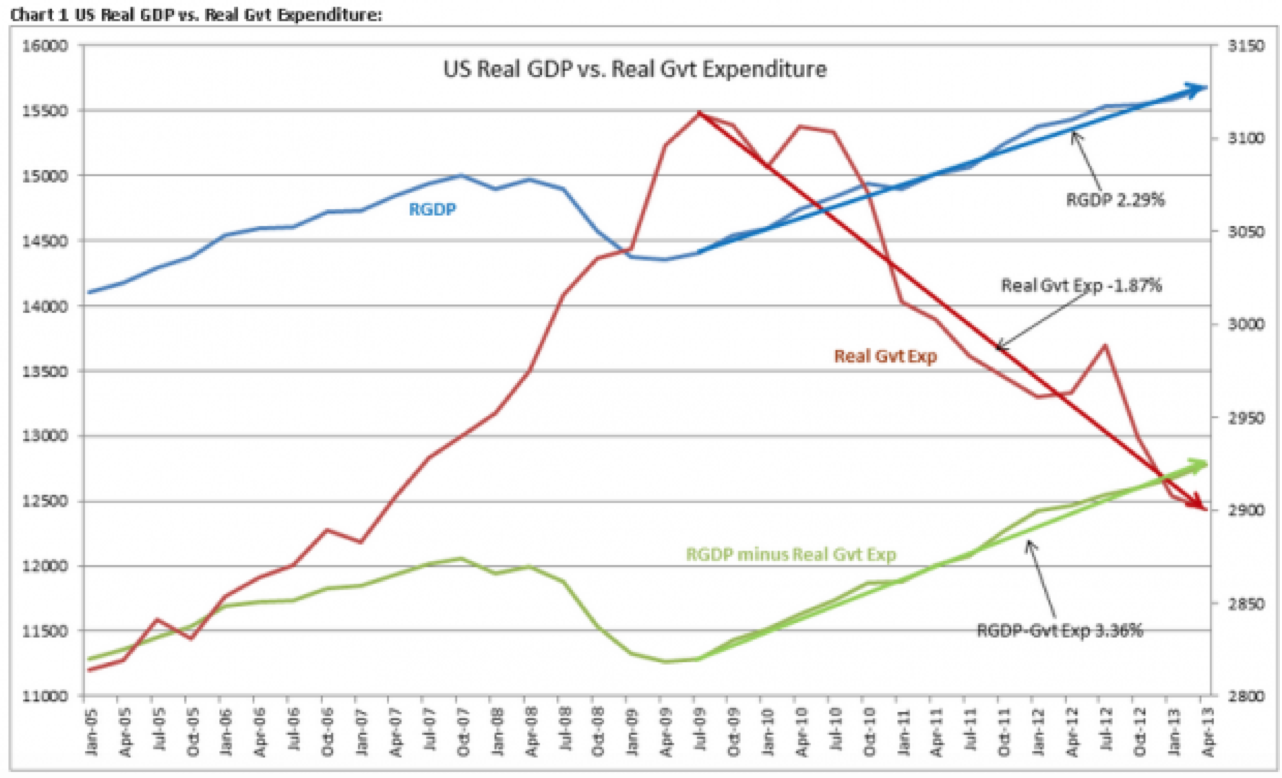

The biggest drag on economic growth is the reduction in government spending as a percent of GDP. The following chart is a little intimidating at first, but it shows three factors. Overall economic growth is reflected in the blue line and is currently around 2.3% annually. This is much slower than usual. The redline shows government spending adjusted for inflation. Since the peak in the summer of 2009, government spending has been decreasing almost 2% a year. Since 2009, the government sector has reduced employment by almost 844,000 jobs. Over the same period, the private sector has added almost 7 million jobs. The stock market reflects the fortunes of the private sector. If we focus exclusively on the health of the private sector we see growth that averages 3.4% since 2009.

As if a government shutdown and a potential historic breach of the debt ceiling weren’t enough to deal with, the President introduced the presumed next Chairman of the Federal Reserve, Janet Yellen. Ms. Yellen will arguably become the most powerful woman in the world, and will be the first woman to chair the Federal Reserve. Stock market investors cheered her nomination as they believe that she will likely continue the aggressive policies of Chairman Bernanke. She is currently the vice-chairman of the Federal Reserve and is widely respected as an academic and a policy maker.

She will place even more emphasis on stimulating the economy. She has stated that the primary objective of monetary policy should be to stimulate job growth. As long as we don’t see a substantial increase in inflation, she will continue to pursue quantitative easing until the unemployment rate drops below 7%. Fed analysts are revising their expectation for an imminent reduction in the Federal Reserve’s bond buying policy. Previously, the consensus was for “tapering” to begin sometime in September. But, given the government shutdown and the regime change at the Federal Reserve, the best guess is that tapering begins sometime in December and continues through 2014.

Although it’s very popular to say that the U.S. is printing money, the reality is that money growth of 7% is equal to the long-term average. In the U.S., inflation is, by almost any measure, well under control. The inflation adjustment to social security is expected to be the lowest since 1975.

In spite of all the concerns about sequestration and the debt ceiling, the private sector of the economy has done very well. The sequestration agreement has the effect of reducing spending. So, this recovery is unique in that typically, increased government spending boosts economic growth. But, for the first time since the Korean War, total government spending has fallen two years in a row. Today, federal government spending is 21% of GDP, right in line with the average over the last thirty years. So far, the economy and the market have overcome this headwind.

The market seems to be saying that things are heading in the right direction. Washington D.C. is paralyzed, but historically, gridlock works pretty well for markets. Ideally, policy would be more predictable and less chaotic. But, once congress retreats from center stage, we should be set up for an improvement in business and consumer confidence.

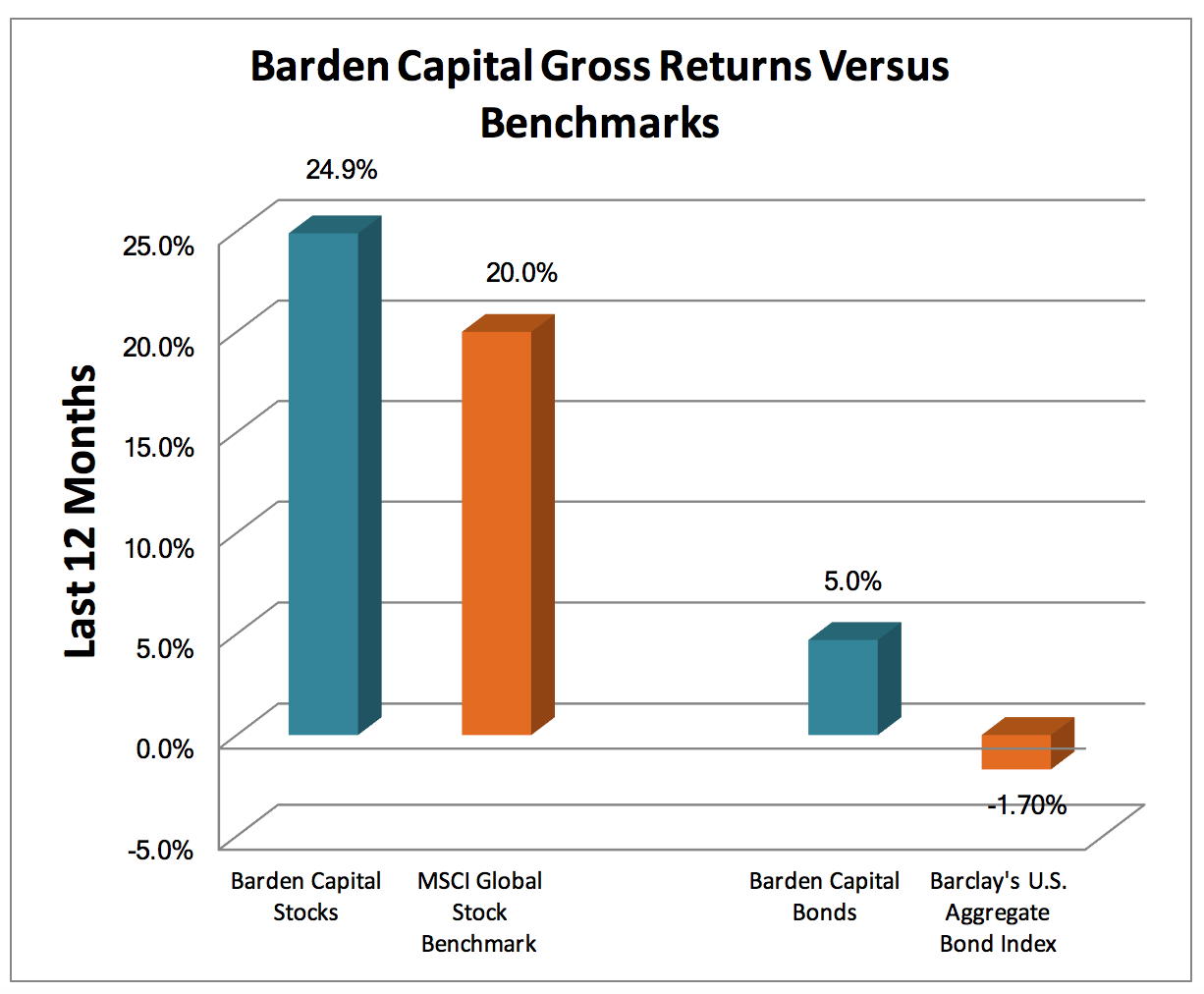

The U.S. stock market is up about 20% over the last year. Europe is up more than 25%. Our portfolios’ heavy exposure to Europe allowed our stocks to produce substantially higher returns than the S&P 500. Our portfolios’ orientation to growth sensitive companies as opposed to over-valued dividend stocks contributed to our stocks outperforming the global stock market.

Our bond portfolios have no U.S. Treasury bonds. Avoiding this underperforming asset class helped our bonds produce positive returns while the overall bond market suffered losses. I see little likelihood of a recession so we have emphasized shorter term bonds from companies with less than pristine credit ratings. We also own securities that earn income from mortgage payments. As foreclosures decrease, this type of investment works very well.