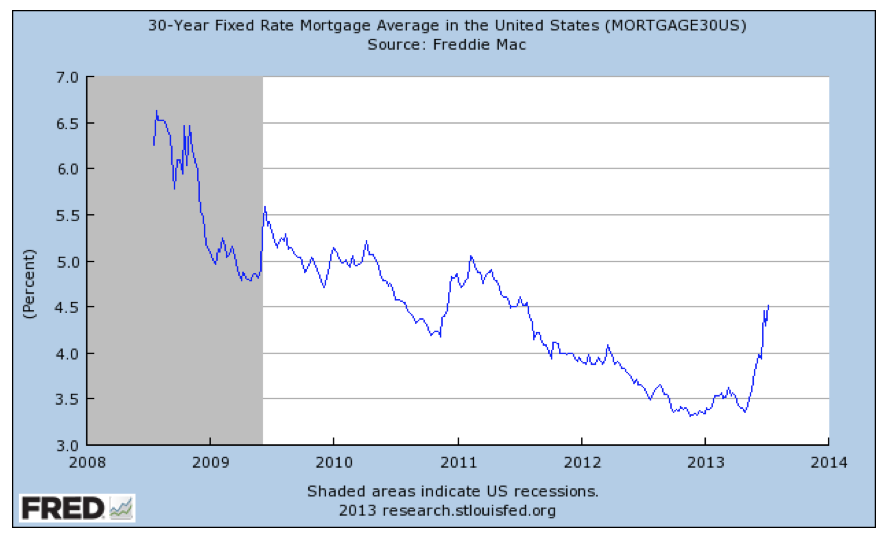

Stocks and bonds both marched to the beat of the Federal Reserve’s outlook. Volatility picked up a bit as mixed signals on monetary policy stoked fears that quantitative easing policy was ending sooner rather than later. 30-year mortgage rates jumped to 4.5% from 3.5% a few months ago.

The increase in interest rates for government and investment grade corporate bonds has left most bond owners under water for the last year.

After Lagging the First Quarter, Economically Sensitive Sectors Dominated the Second Quarter

It was a “risk-on” quarter. Within the stock and bond markets, strategies that emphasize safety and dividends tended to underperform strategies that focus on growth stocks and high yield. Sectors that tend to outperform during periods of better economic activity led the market for much of the last three months.

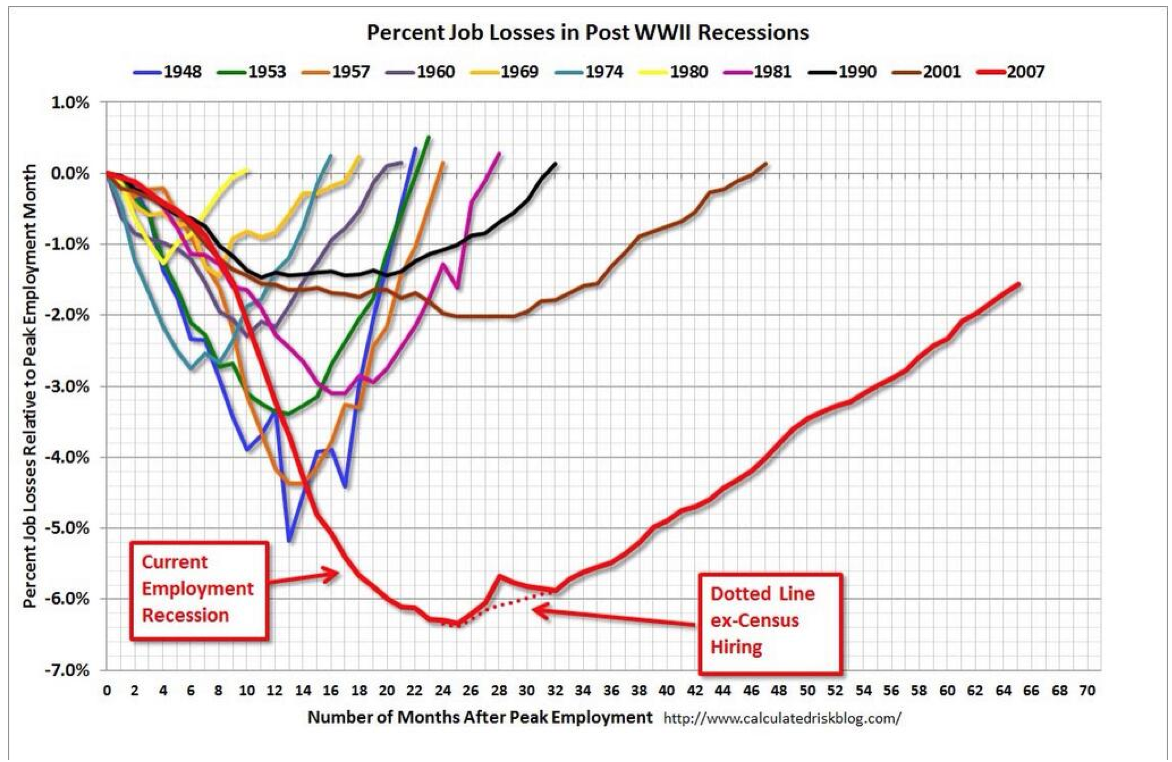

Though the jury is still out on the strength of the economic recovery, the idea that the economy is permanently doomed to stagnation is losing credibility. The economy continues to create about two-hundred thousand jobs a month. The increase in interest rates is a rejection of the belief that this time is different. Fewer investors are betting that the economy is permanently impaired. Most of the prophets of doom have moderated their predictions of an economic collapse.

We’re still a long ways from the pre-crisis employment level, but the recovery persists. It’s difficult to fathom how big of a hole we fell into in 2008. We’re slowly crawling our way out, but it’s taking much longer than any of the recent recessions.

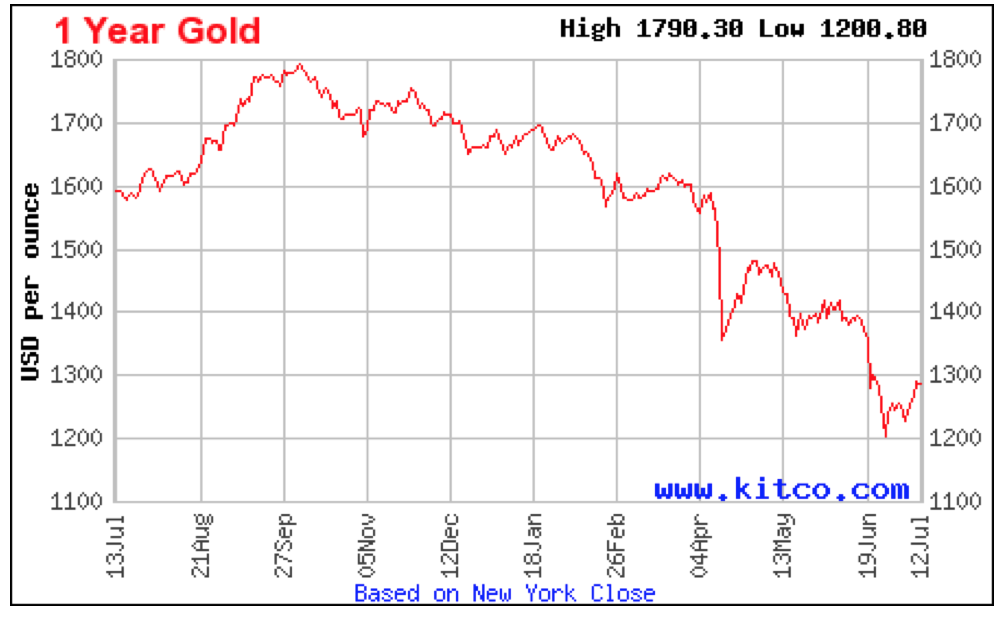

The slow pace implies that the recovery has the potential to persist longer than most recoveries. Inflation is like the redline indicator on the economy. If you don’t slow down, you risk over-heating the engine. When the Federal Reserve initiated its policy of buying bonds many investors assumed that inflation would spiral out of control. Investors increased their allocation to gold as a way to offset a potential collapse in the value of the dollar.

Risk of Runaway Inflation is Minimal

We have lived with Quantitative Easing for almost five years now, and though interest rates are up from their lows, they’re still lower than they were when the Fed started the quantitative easing program. The price of gold has collapsed as investors recognize that the dollar is not only holding its value, but it’s appreciating against most other global currencies.

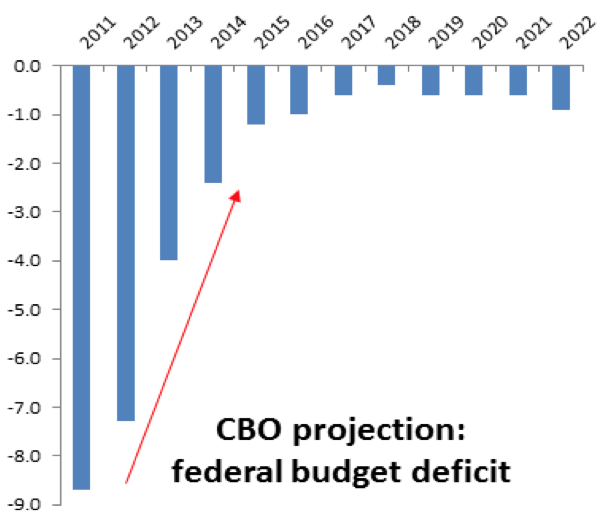

Besides the economy, the most pressing worry for Americans is government spending and the deficit (Gallup, March 26, 2013). The reality is that the deficit is more a function of the economy than government spending. As the economy slumps, unemployment increases. The government offsets this through unemployment payments. As the economy recovers, employment increases and the cost of unemployment benefits decrease. The decline in employment and the economy also leads to a drop in tax revenues. The combination of lower revenues and higher expenses inflates the deficit.

The economic recovery combined with the sequestration based spending cuts is causing the deficit to drop much faster than expected. After peaking at almost 9% of the economy in 2011, the latest projections from the non-partisan Congressional Budget Office anticipate that the deficit will drop to about 1% of the overall economy by 2015. Contrary to expectations that the drop in federal spending would create a recession, the economy has absorbed the cuts. It may not be a boom, but the U.S. is the engine that is pulling the global growth train.

So, it seems that the risks of catastrophe are diminishing. The doom and gloom crowd will always have a large membership. The case against optimism tends to sound more informed, while we optimists are perceived by some as hopelessly naïve. But betting on runaway inflation and a collapse in the economy has been a very painful strategy for the last five years.

Our Clients’ Portfolios Benefitted From Rotation to Economically Sensitive Investments

The second quarter was one our best relative performance quarters in the last few years. We have been steadily selling our blue-chip dividend stocks and increasing our allocation to growth strategies. This shift towards growth stocks is paying off. Our portfolio of stocks was up more than 3%, while the global stock market was up less than 1%.

The performance of our stock and bond portfolios reflects our view that the economy is in a slow but steady growth mode. Our bond portfolios are tilted towards companies that pay a higher yield. The risks to high yield companies increase when the economy turns down. But in the absence of a recession, high yield will continue to be one of the more productive sectors of the bond market.

We also own a good number of collateralized mortgage obligations. The housing market is finally recovering. The number of foreclosures is declining rapidly. As default rates decrease, our mortgage backed securities will likely continue to outperform the government and corporate bond market. Our allocation to mortgage backed securities is a substantial factor in explaining the outperformance of our conservative portfolios.

Bond investors who invest in the large bond funds are licking their wounds after losing money over the last year. I’m very pleased that our portfolio of individually researched bonds is up more than 8% over the same time frame.

Growth will Continue in Spite of the End of Quantitative Easing

The prophets of doom insist that the recovery over the past four years is artificial. They assert that without the Federal Reserve’s policy of “printing money” the economy would collapse. Sooner or later, this economic view will be put to the test.

Markets are pricing in an increasing probability that quantitative easing is going to end soon. This will test the markets’ confidence. How the economy performs after quantitative easing ends is the biggest unknown variable today. If the economy improves in the absence of Quantitative Easing, the market could rally much further.

Easy monetary policy is designed to offset weak credit growth in the private sector. Eventually, deleveraging runs its course. Banks need to lend to increase their profits. When business and consumer confidence improves, they are more inclined to borrow.

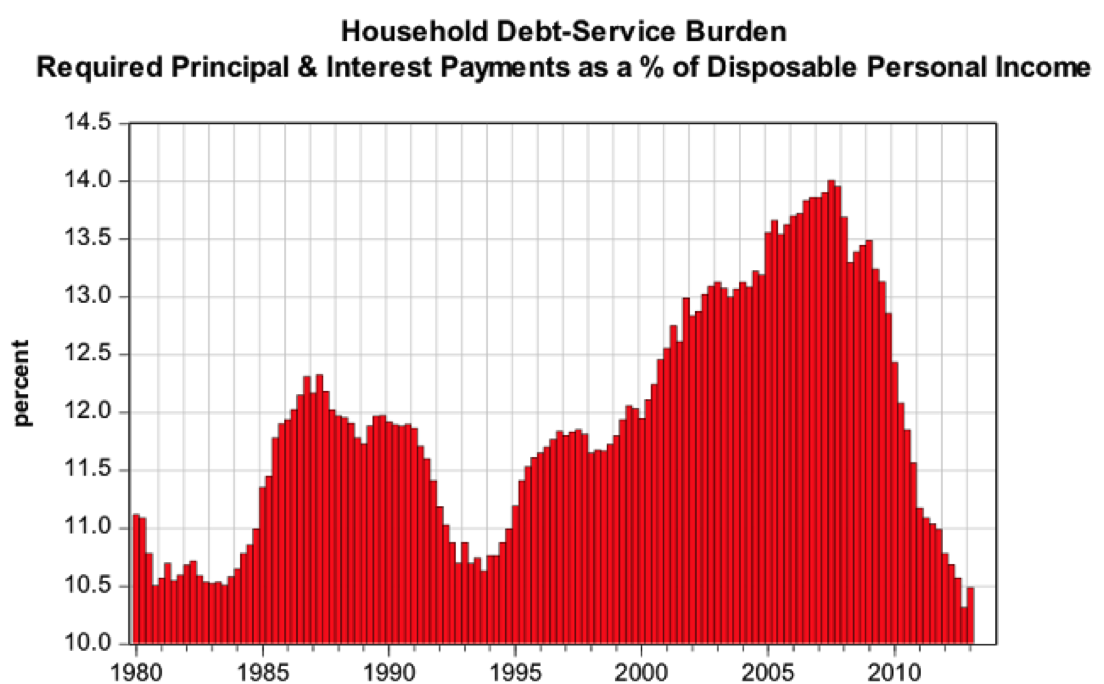

My expectation is that the Federal Reserve will gradually withdraw quantitative easing, as long as banks are sufficiently increasing the amount of credit they extend. The balance sheet of consumers is as healthy as at any time in the past thirty years.

Consumers and businesses have the capacity to increase their borrowing. Based on the history of household balance sheets, the deleveraging pendulum has swung as far as it ever has towards conservatism. If households and businesses buy more on credit, the economic growth rate will accelerate in spite of the Federal Reserve normalizing monetary policy.

Improving economic growth pushes interest rates higher. Stocks should continue to do well as corporate profits improve and most bonds continue to depreciate.