Happy New Year!

The New Year is especially welcome after the endurance test that 2011 became. Politicians in Europe and the U.S. have left the sideshow tent and taken center stage. For now, the U.S. economy is performing better than Europe.

There’s little doubt that Europe’s economy will be weaker in 2012. The only question is how much weaker. Recent actions by the European central bank suggest that the risk of a European depression, at least within the next three years, is very low. But, the market is betting on a European recession.

The market’s main concern is that the European crisis of confidence will get worse before it gets better. Economic forecasts for Europe are projecting a slow or no growth 2012 followed by slow to modest growth in 2013. Our view is slightly more pessimistic. Credit is the lifeblood of an economy. In Europe, government debt is the primary asset on the banks’ balance sheet. As long as the market questions the quality of European government debt, European banks will stay cautious. If banks are less willing to lend, the European economy will drag.

Bond holders are liquidating European debt due to concerns about the budget deficit. This forces the European governments to reduce spending to bring down their annual budget deficits. This process will continue until bond investors are convinced that the deficits are sustainable.

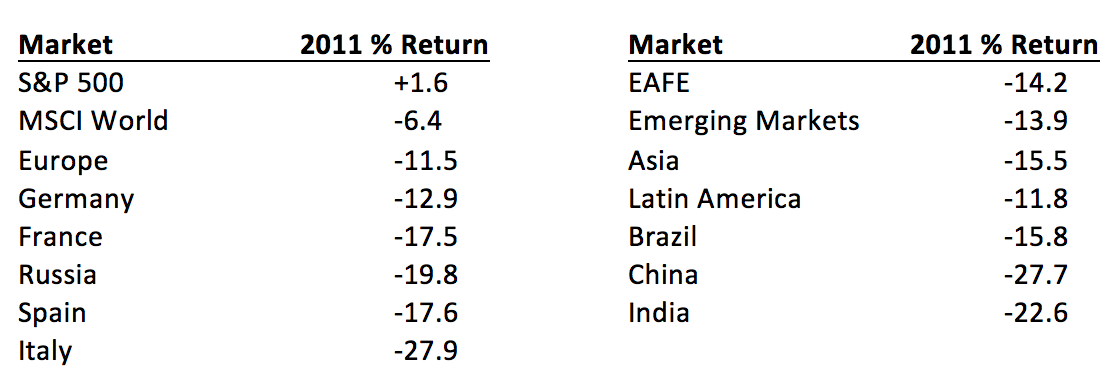

When developed economies like Europe or the U.S. tighten their belt, emerging market economies like Asia and Latin America decelerate. International markets reflected this in 2011:

In spite of the unsettling volatility in the U.S. stock market, the economy has shown surprising strength over the last six months. The economic recovery generated 1.6 million jobs in 2011, and consumer confidence is slowly improving. Optimists assert that the U.S. has “decoupled” from Europe, and that in spite of the slowdown across the Atlantic, the U.S. economy should grow at least two-percent over the next year.

The biggest question facing investors in 2012 is whether Europe will gain from the U.S. experience in 2008 and successfully implement a policy that prevents a Lehman style banking collapse. If we assume that Europe slides into a recession, but is able to avoid a banking crisis, the odds that the U.S. and the rest of the world can side-step a recession improve greatly.

The Eurozone represents seventeen percent of the global economy. The most troubled economies, Greece, Italy, Spain and Portugal represent less than nine percent of the global economy. Continuing recovery in the U.S. should be enough to carry the global economy until Europe stabilizes.

After maintaining sizable portfolio holdings in European and emerging market economies, we spent most of the year reducing our exposure to non-U.S. companies. As long as investors stay cautious, they will emphasize U.S. stocks as a safe-haven. In 2010, the most aggressive segments of the market like small stocks and emerging market stocks substantially outperformed higher quality companies. The reverse was true in 2011.

The result of our move out of many emerging market and international companies was substantial. Our multi-strategy growth portfolios outperformed the global stock benchmark by more than five-percent in 2011. Companies with low volatility, that pay a high dividend, and that generate most of their revenues domestically led the market. The Utility index was the best performing index in the world. This is likely to continue until investors are convinced of the recovery’s sustainability.

Four years have passed since the Great Recession hit and took out 8.7 million jobs. Each month of strong job creation increases the hope that the U.S. may be in a virtuous cycle of job growth, healthier spending and higher demand. As long as there is excess capacity in the economy, this process can feed on itself. There is no shortage of long-term concerns, but for the next few years, if the headwinds from Europe aren’t over-whelming, it’s quite possible that economic growth will accelerate.

Once the market believes that the worst of the crisis of confidence has passed, the markets will perform similarly to 2009-10. The dilemma for portfolio managers is whether it is more productive to anticipate the inevitable recovery, not knowing when it will occur, or whether it makes more sense to wait until the turn. Europe could take some time to sort-out. Until then, we are emphasizing quality factors in our companies like dividend growth and free cash flow yields. In effect, we’re acknowledging that while it’s raining it makes sense to carry an umbrella. I’m confident that we will react in a timely manner when it seems like the sun is starting to come out.