A Year for the Record Books

While we had high hopes, very few people predicted at the beginning of 2013 that the stock market would produce such extraordinary returns. Here’s what I wrote in your October, 2012 letter:

If we can avoid a major policy mistake over the next few months, the market should be set up to rally substantially in 2013. It’s been a long road back from the lows of 2008 and 2009, but the market and economy continue to adapt to the “new normal.” This is the historic pattern. Each crisis is different, except that they all are eventually resolved.

As it turned out, 2013 was the second best year of the last decade. Globally, stocks were up more than 27%. Our clients’ stock portfolios were up about 32% on average. The outperformance of our selections is attributable to our overweighting the portfolios with economically sensitive stocks. Defensive, low volatility, dividend paying stocks lagged the market for the first time in years as investors pursued more aggressive strategies.

After such a strong year, many are wondering whether the market has gone up too far, too fast. Should we continue to add to the stock market when it is at all time highs? This is a reasonable concern, but the historic fact is that stocks are likely to continue to go higher even from all time highs. It took sixteen years for the Dow Jones to match the high of 1966. If an investor would have sold when it finally set a new all time high in 1982, they would have missed one of the greatest bull markets in history. The Dow Jones went from 1,000 in 1982 to over 10,000 in less than twenty years.

Of course this is a long-term result. Over the short-term, markets can be volatile. A sell-off of at least twenty percent is inevitable at some point. We just don’t know whether it will occur this year or five or even ten years from now.

Stocks Are Still a Compelling Value

I use a couple different yardsticks to measure the intrinsic value of the stock market. The first compares the current earnings yield of stocks to the historic average. The second looks at stocks’ earnings yield compared to the yield of corporate bonds. In both cases, stocks are still cheaper than they should be, by about 15% or so. When you add in expected earnings growth of 10% for 2014, the stock market can increase by another 25% before it would appear to be getting ahead of itself.

The alternative to the stock market for most investors is the bond market. Compared to the return on bonds today, stocks are far more appealing. Last year, the average bond investor lost about 2%. Fortunately, our focus on short-term corporate and mortgage backed securities helped us to achieve a positive return of over 4% on our bond positions.

As the economy continues to recover, companies will demand more financing in order to expand production. As demand for financing increases, interest rates increase. When interest rates increase, the prices of existing bonds decrease. So for 2014, it looks like more of the same for bond owners. Another mediocre year of bond returns will likely accelerate the investor exodus out of bond funds and some of these assets will find their way into the stock market.

We will not likely see a repeat of last year’s exceptional stock market performance. But, if the economy continues to move forward and the deficit continues to fall then earnings will grow and confidence will improve.

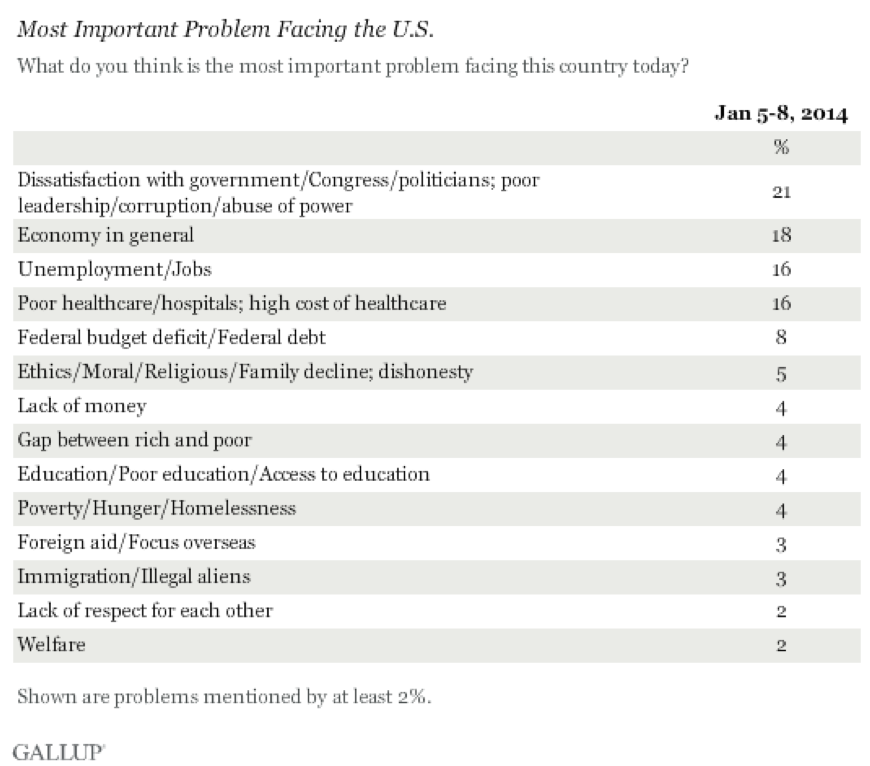

Economic and political concerns continue to dominate the list of what keeps Americans up at night. But a subtle shift is occurring. For the last few years, the top three concerns were the economy, unemployment and the deficit. Now, dysfunctional politicians are perceived as the biggest problem facing us. The decline in economic concerns suggests that confidence is very slowly improving.

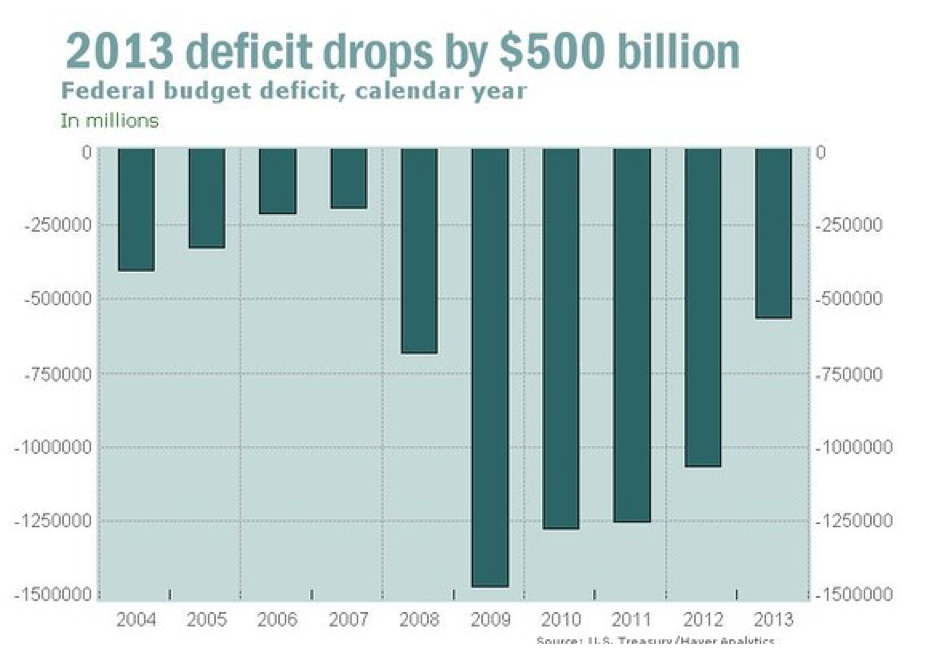

Americans are very perceptive. Unemployment continues to decline, the economy continues to grow, and the combination of these developments is leading to a rapid drop in the size of the deficit. The deficit is now a little more than one-third the size it was during 2009. We are slowly but surely pulling ourselves out of the hole that the housing crisis knocked us into.

The End of Quantitative Easing?

In spite of all the warnings that the Federal Reserve’s policy would inevitably lead to inflation, inflation is historically low. In 2014, Social Security beneficiaries will get a 1.5% increase in benefits. For the second year in a row, the program’s cost-of-living adjustment will be below two percent. This is only the seventh time in the past forty years that inflation has been below 2%.

Interest rates will likely increase, if only for the reason that they’ve never been lower. But, investors have thought this for years, and we’re still at very low interest rates. Former Treasury Secretary Lawrence Summers suggested that inflation may not necessarily get back to historically normal levels of 3% or so per year. He argues that over the last fifteen years we have had low inflation in spite of an abundance of easy credit. This credit led to massive over-investment in technology and housing, yet inflation never got out of hand. Today, in the absence of extraordinarily easy credit, it’s difficult to conceive of the inflation of the 1970s making a comeback. The risk of runaway inflation is further mitigated by the wind-down of the Federal Reserve’s bond buying program.

Economists are mixed as to the impact of the Federal Reserve’s Quantitative Easing policy. The Federal Reserve has purchased nearly four trillion dollars’ worth of bonds and mortgages from U.S. banks, but most of the cash that banks received for these bonds is still sitting harmlessly in the vaults at the Fed. Banks are obliged to hold what are called “required reserves”–usually around ten percent of deposits. Banks can also choose to hold what’s called “excess reserves” at the Fed. Under quantitative easing, excess reserves have grown to $2.3 trillion. So it seems that most of quantitative easing has been little more than an accounting exercise. The cash that the Fed used to buy the bonds never left the Fed, it was simply re-classified as excess reserves.

Economy and Stock Market Have Room to Run

The implication is that the end of quantitative easing may not mean the end of the economic recovery. A couple of years ago, pessimists worried that the economy couldn’t handle a cut in government spending or an end to the Bush tax cuts. Yet over the next three years, the economy continued to slowly improve. Now, forecasts for global growth suggest that 2014 will be the best year since 2010. As long as the economy continues to grow, earnings will increase, and stock prices should also.

Perhaps there has been a modest impact on interest rates, but the imminent end of Quantitative Easing will not necessarily cause interest rates to jump. Since Chairman Bernanke announced that the Fed would begin to wind down Quantitative Easing, interest rates have dropped. My feeling is that the confusion and uncertainty that resulted from Quantitative Easing outweighs the benefits of marginally lower interest rates, especially given how low interest rates were prior to the inception of the Quantitative Easing program.

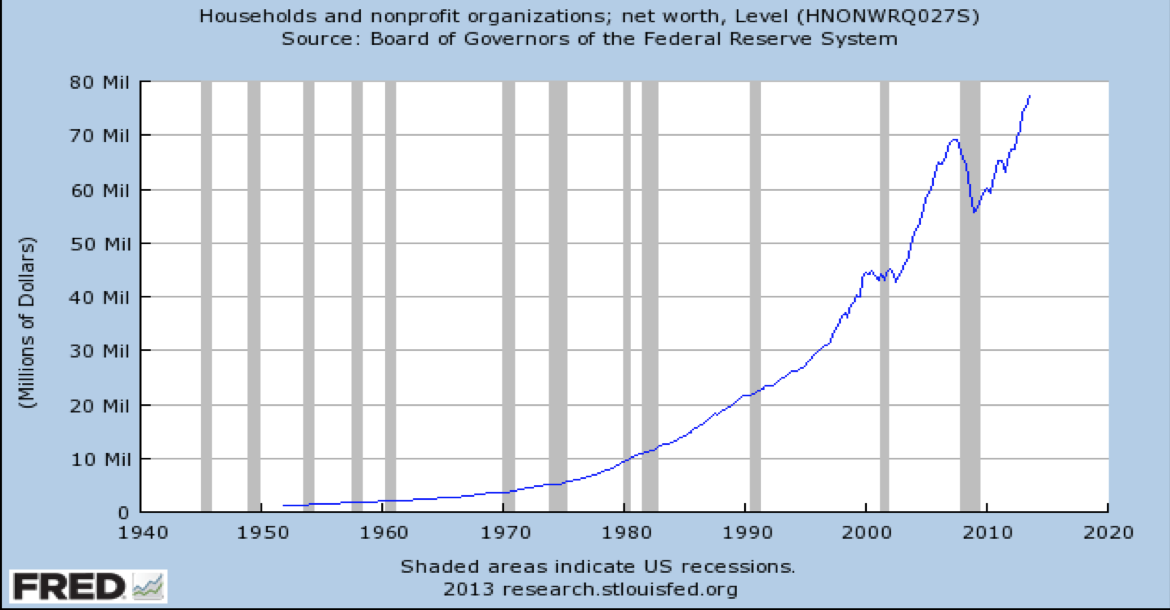

U.S. Household Wealth Hits All-Time High

The increase in the stock market and property values recently caused the wealth of U.S. households to hit an all-time high. This recovery is significant. The decline in household net-worth is one of the most unique aspects of the Great Recession. We did not see a substantial drop in household net worth in any of the prior recessions since World War II.

So, this time was different and we didn’t know how long it would take to repair the damage. Now that household balance sheets have recovered, the need for households to pay off their debt is less urgent. This means that households will be more likely to spend excess income instead of pay off credit cards, providing additional support to the economic recovery.

Some analysts claim that the economic recovery is artificial, and that the economy is relying on artificial support. When the recovery continues in spite of the absence of Quantitative Easing, the masses of investors that question the sustainability of the current recovery will likely come around to the idea that the recovery is legitimate. If this shift in opinion is widespread, it will send a new wave of money into the stock market as people who have stayed on the sidelines come back into the market. If this occurs, the returns of 2013 may be just one of many years of pleasantly surprising results.

Thank you for your continued trust,

Eric Barden, CFA