The market is dealing with a number of uncertainties following an exceptionally smooth and steady 2013. Investors had to adjust to a new head of the Federal Reserve and the possible implications to monetary policy. An overthrow of the Ukrainian government led to Russia’s annexation of Crimea, a Ukrainian province with historic ties to Russia. Most recently, investors are questioning the valuations of some of the most widely admired growth stocks.

Chairman Bernanke led the Federal Reserve for the past eight years. He is credited with developing much of the response to the credit crisis of 2008-9. It takes a few meetings for a new Fed chair to learn Fed speak. Any statement that confuses the market has the potential to undermine market confidence.

Not surprisingly, Chairwoman Yellen’s first press conference sent the market into a tailspin when she seemed to indicate that she would raise interest rates faster than expected. The reality is that she is very data dependent. If the economy booms, they’ll raise interest rates sooner. If the economy stays sluggish, interest rates won’t go up until next year. It will take a few meetings before Chairwoman Yellen’s guiding principles are accurately understood.

Dr. Yellen’s appointment won’t change the policy of the Federal Reserve. We are in good hands. She is widely regarded as one of the most astute experts on monetary policy. She even mentored Chairman Greenspan on contemporary academic economics:

“I understand 90%, 95% of what they’re writing,” Greenspan told CNBC, referring to academic economists. “But there’s a small amount which I don’t know and I want to know. And I often found that I would go to Janet.” “When I didn’t know it, she did. And she explained it to me,” Greenspan said of Yellen, the current Fed vice chair and a former UC Berkeley economist.

Russia is more of a challenge to the market. It’s highly unlikely that Russia would attempt to take over Ukraine like it did Hungary and Czechoslovakia during the height of the Cold War. Directly rebelling against the top economic powers, specifically Germany, England and the U.S, would severely cripple the Russian economy. Over 100 Russian billionaires would no longer be permitted to travel freely to their apartments in Manhattan, London and Paris. Bond markets would severely limit Russia’s ability to finance its government. But, that might not prevent Russia from supporting efforts by ethnic Russians to secede from Ukraine.

The market will bounce back from some political instability in Europe as long as it’s limited to Eastern Ukraine. A move into Kiev or Western Ukraine would reignite fears of an aggressive Russia. But for now, Putin continues to speak loudly and carry a small stick. This is not a crisis that should impact the global economy in a significant way, even if the Ukraine falls into a civil war.

The initial, knee-jerk reaction of investors when confronted with a new, potentially scary possibility is to run for cover. This means selling the stocks that performed the best last year, as well as the stocks that are highly valued based on future growth prospects. Investors also sell more economically sensitive sectors and move into defensive sectors like electric utilities and health care. People may even change their long-term asset allocation and hide out for a while in bonds and money markets.

We concentrate our stock investments into high quality growth companies that are undervalued. I don’t find the safe, but low yielding utilities to have any long-term appeal. Our portfolios generally underperform the market during periods when investors are panicking out of growth stocks, and this time is no exception. As hedge fund managers buy into low-growth, defensive areas like utilities and high dividend paying stocks, we are staying the course with our high quality, undervalued portfolio.

The market hit an all-time high on April 4th. Since then, large, blue chip stocks are down about 4% from their highs, but that understates the sell-off for most stocks. Small, high growth stocks that have led the bull market over the last five years are down about 12% from their highs. These corrections don’t last forever, and judging by the anxiety that this mild sell-off has provoked, I’m fairly confident that we’re closer to the end of this reversal than the beginning. The economy continues to recover, earnings are strong, and valuations are very reasonable.

The real bear markets that take stocks down by 20% or more almost always coincide with an economic downturn. That is not happening anytime soon. We can attribute some current economic weakness to the absurdly long winter. As the weather turns more favorable, construction will pick back up. Unemployment is falling, the deficit is falling, and interest rates are extremely low. This is not what a peak in the economy looks like.

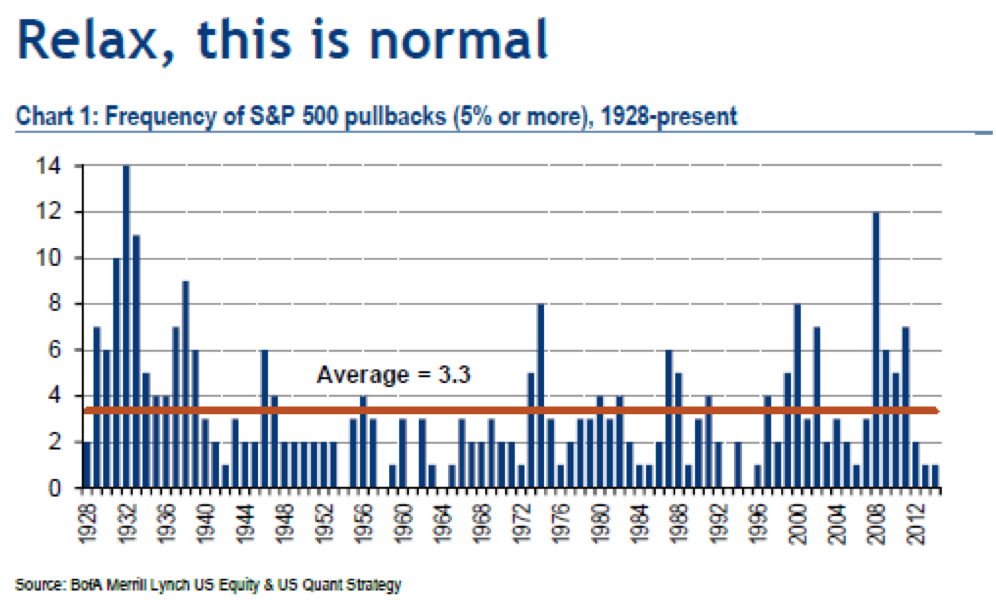

So, it’s most likely that this is just another momentary bump in a long-term recovery for stocks. Selling into this kind of turbulence is rarely profitable. The market has dropped 5% or more 19 times since this bull market began five years ago. These sell-offs can end as quickly as they begin. In spite of these 19 modest sell-offs, the market is up over 175% in the last five years. Yet, in each and every correction, some financial pundits have argued that this sell-off is the big one. Over the last 85 years, the market averages approximately three downturns of this magnitude each year. This time may feel a little worse than usual, since the last couple of years were unusually smooth.

Investors are moving out of the stocks that performed the best over the last two years. Internet and social media stocks, along with biotech companies had been investors’ favorites. Many of the fast money hedge funds crowded into the companies that are showing the fastest revenue growth. When these companies started to underperform earlier this year, many hedge fund managers headed to the exits all at once. Stocks are still the best asset to own for long-term growth, but the leaders in 2014 will be a very different group than the companies that led in 2012 and 2013.

It’s critical that investors keep these bumps in perspective. Twenty years ago, the Dow Jones was struggling between 3,600 and 4,000. Today, the Dow is at 16,221, more than a fourfold increase in twenty years. Thirty years ago the Dow was stagnant and going nowhere for all of 1984. It finished the year below where it began, falling from 1258 to 1211. Investors who were able to ignore the market noise would benefit from a more than thirteen fold increase in their money over the next thirty years.

When we help you determine how much of your assets should go into stocks, we are not concerned about the next three, six or twelve months. We are concerned about the most productive investment allocation for the next twenty and thirty years. In this respect the market is sort of like the ocean. Many investors try and time each individual wave. Our focus is on understanding the tides, whose movements are much more significant and predictable. The tide in our case is the economy, and that tide is still going higher.