Remembering Black Monday — 1987

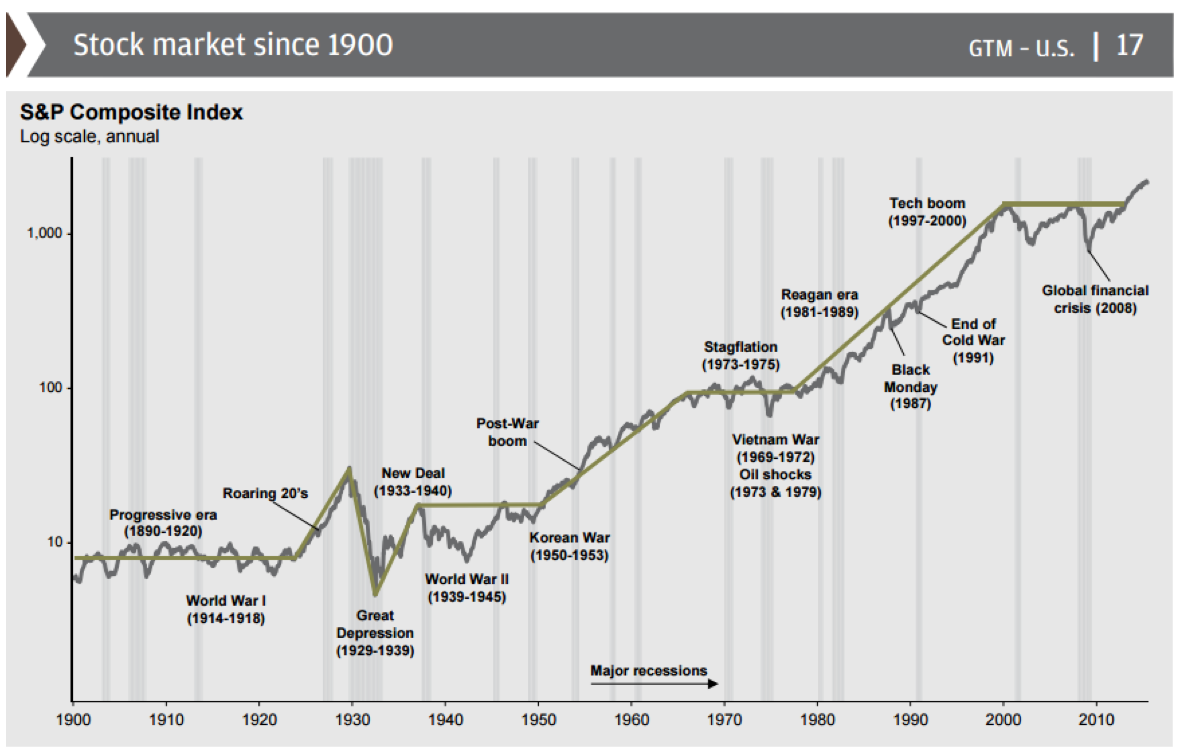

I was fourteen years old on Black Monday. Baseball was much more interesting than the stock market, but, it was impossible to miss what occurred on October 19th, 1987. The S&P 500 fell more than 20% that day, bottoming at 224.84.

The New York Times headline asked “Does 1987 Equal 1929?” Of course nothing resembling 1929 or the great depression was forthcoming. The market quickly rebounded and the bull market of the ‘80s and ‘90s had another twelve years to run. The U.S. economy was much more resilient than short-term market behavior indicated.

When we look back at 1987, even in spite of all the volatility of the last 28 years, the S&P 500 still grew from 222 to almost 2,100! Since Black Monday, U.S. stocks generated a total return of more than 10% a year! Over a thirty-year period, even events like Black Monday are relatively insignificant.

Is Global Bull Market Finished?

The U.S. stock market has increased in value every year since 2009, but the S&P 500 is struggling to extend its winning streak. The Chinese stock market fell 38% over the summer. The global collapse of energy prices is pinching profits for energy companies as well as the industrial companies that service the energy sector. The decrease in earnings visibility is causing investors to question whether earnings will grow at all in 2016.

On August 24th, the Dow Jones dropped 588 points—2015’s version of Black Monday. In percentage terms the Dow only lost about 3% of its value, but that was enough to wipe out the meager gains made so far in 2015. At the end of September U.S. stocks were down about 15% from their peak. Now, three weeks later, global stock markets have almost completely recovered.

The kind of volatility we’re seeing this year is not that unusual. This year is playing out very similarly to 2011, 2012, and 2013. During these years, the market was fairly slow and steady until the summer. For various reasons, the markets fell about 10% before rebounding to end the year with positive gains.

It’s too soon to tell how the rest of the year will play out, but there are some positive developments that suggest the worst is behind us. Once earnings expectations reflect the new reality, earnings estimates find a floor. As we move forward into 2016, corporate earnings growth will reflect the strength of the global economy, rather than the one-time distortions of falling energy prices and a stronger dollar. Current estimates are for S&P 500 earnings to grow almost ten percent in 2016. Adding a two percent dividend yield to this appreciation implies that the intrinsic value of U.S. companies will appreciate by about 12% over the next year.

The Global Economy is in Transition

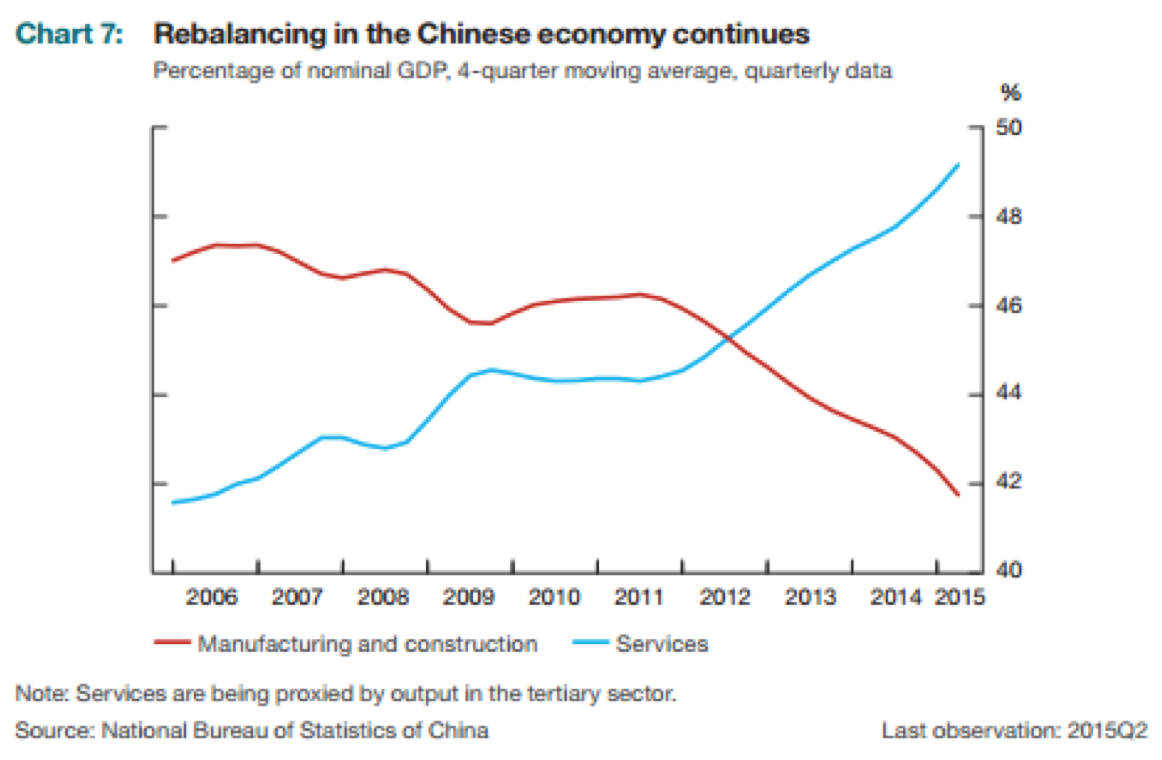

China seems to have steadied for the time being. The worst fears were that China was going to fall into a 2008-9 abyss of a credit crisis with disastrous consequences for global growth prospects. The reality seems more benign. China’s economic growth will naturally slow as it transitions from an export oriented economy to a more diversified, consumer oriented economy. This transition is healthy and predictable. Though the Chinese economy, and perhaps the global economy will grow more slowly, the stability of the global economy is improving.

Most investors focus on faster growth rates as the driver behind increased valuations. An equally powerful driver is when growth becomes more predictable. Given two investment options with comparable future growth expectations, investors prefer to own the investment with the greatest likelihood of sustaining that growth rate.

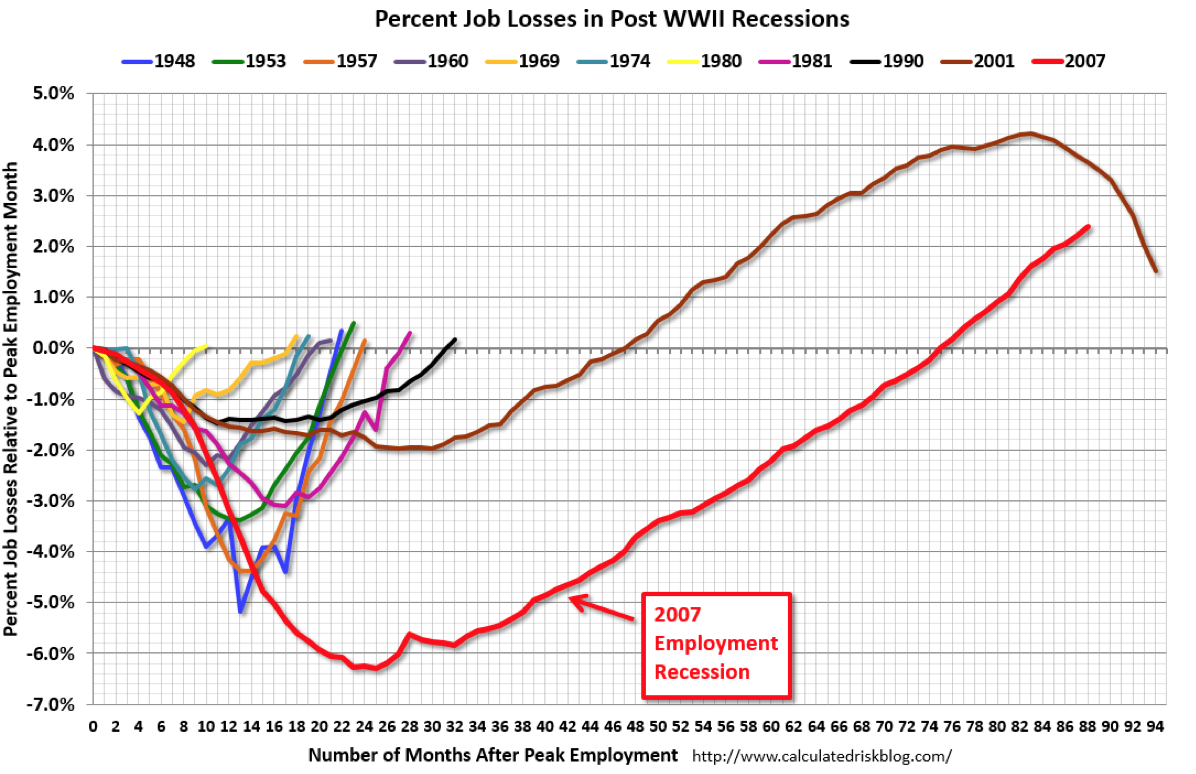

Business cycles are the “ups and downs” in economic activity, defined in terms of periods of expansion or recession. During expansions, the economy, measured by indicators like jobs, production, and sales, is growing–in real terms, after excluding the effects of inflation. Recessions are periods when the economy is shrinking or contracting. Recessions are an unavoidable aspect of a free market economy. They cleanse the economy of the imbalances that result during prolonged periods of growth. Think of recessions as the course corrections that ensure the economy stays on track long term.

Major economies typically progress from agrarian to industrial to service oriented. The farming oriented economy is the least predictable. Farming economies experience severe booms and busts as supply and demand is very hard to balance consistently. The United States reflected this pattern of growth in the 1800s. Industrial economies are more stable than agrarian economies, but they are still vulnerable to significant shifts in the prices of commodities and interest rates.

The most diverse, stable phase of economic development is when an economy evolves into a service oriented economy. In 1990, manufacturing was the leading employment sector for thirty-six states. Today, manufacturing leads in only seven. The U.S. has become much more service oriented. Health care and business consulting are taking the lead away from energy and manufacturing. This should lead to an economic growth profile that is more subdued, but also much more steady.

Rather than enduring a recession every five years or so, it’s possible that recessions will become much less frequent. If recessions are less frequent, then it is likely that bear markets will also become less frequent. Fewer bear markets means that investors should be willing to pay higher prices for stocks than what they did in the past, when the economy was much more volatile.

The engines of global economic growth are becoming more diverse. The Chinese transition is not as advanced as the United States’, but investors should recognize that the current slowdown in Chinese economic growth could be symptomatic of a transition to a more advanced phase of economic development. In the long-term slow and steady is much better than fast and volatile.